WTI Crude - Bouncing Off to Reclaim the Recent Top

rhboskres

Publish date: Wed, 27 Oct 2021, 05:05 PM

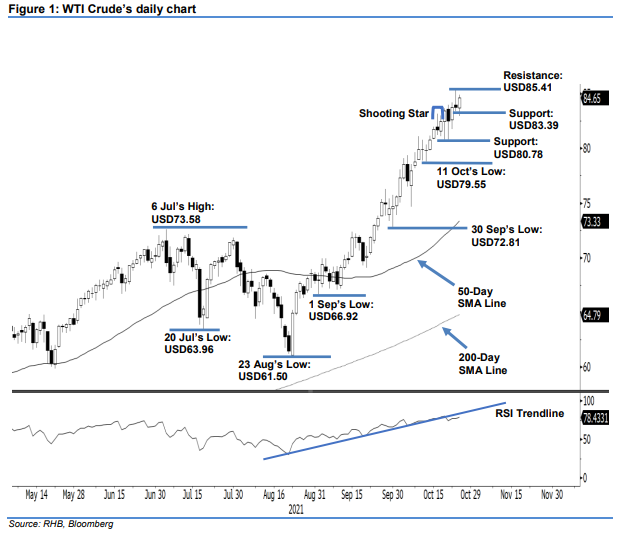

Keep long positions. Following Monday’s profit-taking, the WTI Crude rebounded higher yesterday, which saw it rising USD0.89 to settle at USD84.65 – it recouped all the intraday losses to close higher. The commodity opened at USD83.72 and oscillated in a sideways direction towards the European trading session – it hit the day’s bottom at USD82.97. Following the US trading session, buying interest kicked in strongly to lift the WTI Crude higher to hit the intraday high at USD84.88 before retracing at the close. The latest white body candlestick with long lower shadow that bounced off above the USD83.39 immediate support signals that the bullish momentum is in the process of renewing before possibly breaching the USD85.41 immediate resistance. With the RSI strength having been renewed positively yesterday, there are higher odds for the commodity to persist with the bullish momentum. Unless the trailing-stop mark is breached, we retain our bullish trading bias.

Traders should stick to the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage the trading risks, the trailing-stop threshold is set at USD83.39.

The support levels are eyed at USD83.39 – 25 Oct’s low – and USD80.78, ie 20 Oct’s low. The resistance level is pegged at USD85.41, or 25 Oct’s high. This is followed by the USD90.00 round number.

Source: RHB Securities Research - 27 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024