COMEX Gold - Retraced to Consolidate Near the Immediate Support

rhboskres

Publish date: Wed, 27 Oct 2021, 05:07 PM

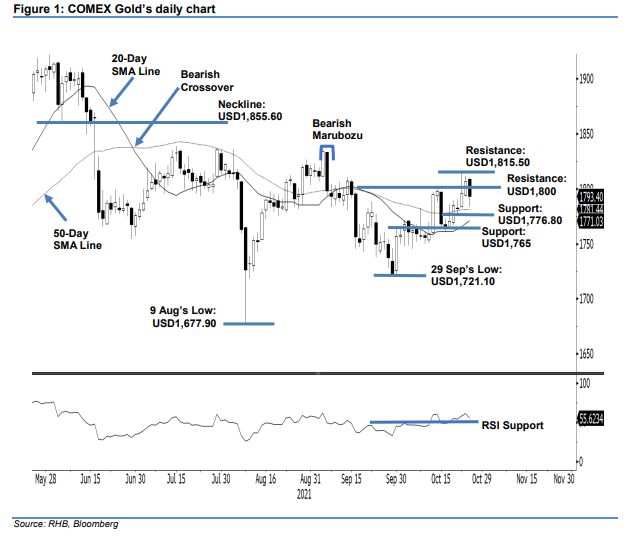

Maintain long positions. The COMEX Gold failed to establish a foothold above the USD1,800 level, falling USD13.40 to settle at USD1,793.40. It started Tuesday’s session higher at USD1,808.70. Bullish momentum failed to sustain, and the index travelled downwards to the day’s low of USD1,783 during the US trading session. It rebounded from the 50-day SMA line to close at USD1,793.40 – printing a black body candlestick with a long lower shadow. The latest price action showed strong support at the 50-day SMA line. As long as the commodity stays above the moving average line, the bullish structure will remain intact. It may consolidate sideways before attempting to cross above the USD1,800 psychological mark. At this stage, we believe upside risks remain, and keep our positive trading bias.

We advise traders to stick with the long positions initiated at USD1,784.90 or the closing level of 20 Oct. To manage downside risks, the stop-loss is placed at USD1,760.

The immediate support remains at USD1,776.80 – 21 Oct’s low – followed by the USD1,765 whole number. Towards the upside, the nearest resistance is eyed at USD1,800, followed by USD1,815.50, or the high of 22 Oct.

Source: RHB Securities Research - 27 Oct 2021