E-Mini Dow - Strong Bearish Reversal From the Top

rhboskres

Publish date: Thu, 28 Oct 2021, 05:06 PM

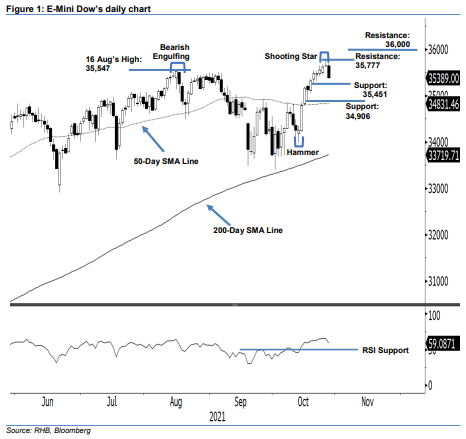

Trailing-stop mark triggered; initiate short positions. The E-Mini Dow reversed its downwards trend yesterday after a strong 255-pt fall towards the close at 35,389 pts – breaching below the 35,618-pt trailing-stop level. The index started neutral at 35,646 pts and whipsawed in a mildly positive tone, which saw it hit the intraday high of 35,715 pts during the early US trading session. It then swiftly changed its direction southwards where strong selling pressure forced the E-Mini Dow to fall strongly – htting the intraday low at 35,383 pts before the close. Following Tuesday’s “Shooting Star” candlestick, yesterday’s long black candlestick has confirmed the bearish reversal signal for the index is continuing to fall lower. We believe the bears will bring it further towards the immediate support level of USD35,451 in the coming sessions – in line with the weakening RSI, which is pointing below the 60% threshold. Since the trailing-stop mark is breached, we shift to a negative trading bias.

We closed out our long positions initiated at the closing level of 7 Oct, or 34,638 pts, after the trailing-stop mark at 35,618 pts was triggered. Conversely, we initiate short positions at the closing level of 27 Oct at 35.389 pts. To manage the trading risks, the stop-loss threshold is set at 35,777 pts.

The immediate support level is revised to 35,451 pts or 25 Oct’s low. This is followed by 34,906 pts, ie 18 Oct’s low. On the upside, the immediate resistance is pegged at 35,777 pts before possibly reaching the 36,000-pt level.

Source: RHB Securities Research - 28 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024