Hang Seng Index Futures - Pulling Back to Test the Immediate Support

rhboskres

Publish date: Thu, 28 Oct 2021, 05:07 PM

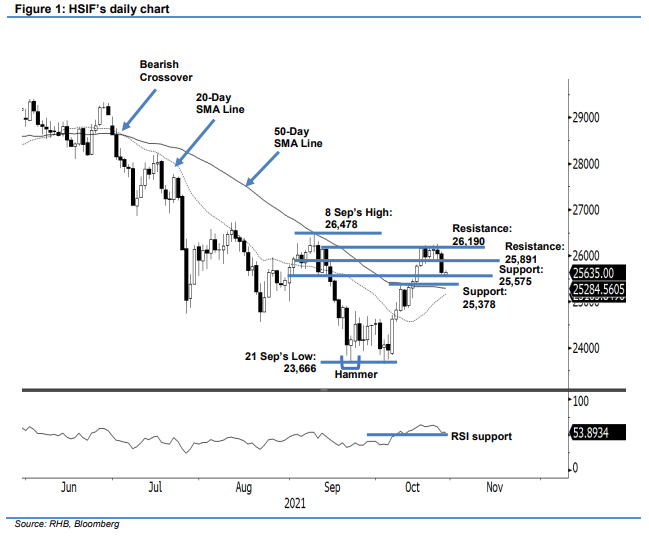

Maintain long positions. The HSIF saw the negative momentum extend yesterday, declining 399 pts to settle the day session at 25,640 pts. The index initially opened weaker in the morning at 25,791 pts. After touching the 25,823- pt day high, it dipped towards the 25,554-pt day low. It rebounded mildly later in the afternoon to close at 25,640 pts. During the evening session, the HSIF’s volatility tapered off – it last traded at 25,635 pts. For the last two sessions, the bears were eager to take profit before the futures contracts expire. Due to rollover acitivites, the index may now gyrate near the immediate support with high volatility. We retain the view that the 50-day SMA line will provide a strong downside support. We have seen the 20-day SMA line moving higher – we believe it is looking to cross above the 50-day SMA line. If the bullish crossover happens, this may enhance the technical setup. We stick to a positive trading bias until the trailing-stop mark is triggered.

We advise traders to keep the long positions initiated at 24,809 pts, ie the closing level of 7 Oct’s evening session. To control the downside risks, the trailing-stop threshold is fixed at 25,250 pts.

The nearest support is marked at 25,575 pts –1 Sep’s low – and followed by 25,378 pts, or the low of 19 Oct. Conversely, the immediate resistance is pegged at 25,891 pts – 14 Sep’s high – and followed by 26,190 pts, ie 13 Sep’s high.

Source: RHB Securities Research - 28 Oct 2021