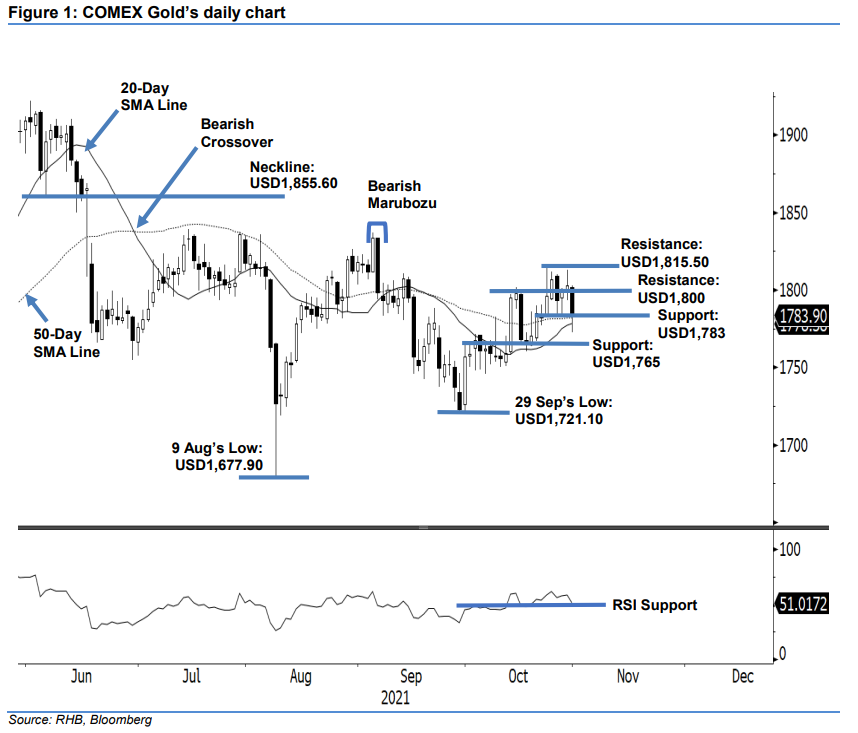

COMEX Gold: Struggling to Stay Above USD1,800

rhboskres

Publish date: Mon, 01 Nov 2021, 08:45 AM

Maintain long positions. The COMEX Gold gave up the USD1,800 level last Friday, declining USD18.70 to settle at USD1,783.90. The session initially opened stronger at USD1,801.50. After it started off, the commodity saw selling pressure gradually accelerating, dragging prices lower. The precious metal plunged to the USD1,772.40 session low just before the US trading session began and then closed weaker at USD1,783.90. The latest session showed the COMEX Gold is moving lower on a weekly basis – just staying marginally above its 50- day SMA line. In the event it falls below the 20- or 50-day SMA lines, sentiment will become weak again. For the immediate session, the commodity is likely to consolidate along the moving average lines until volatility picks up again this week. Pending the resumption of upwards movement, we stick to our positive trading bias, with the stop-loss level adjusted higher.

Traders should maintain the long positions initiated at USD1,784.90 – this was the closing level of 20 Oct. To limit the downside risks, the stop-loss threshold is adjusted to USD1,765.

The immediate support remains at USD1,783 – 26 Oct’s low – and is followed by the USD1,765 whole number. The nearest resistance is eyed at the USD1,800 round figure, followed by 22 Oct’s high, ie USD1,815.50.

Source: RHB Securities Research - 1 Nov 2021