Hang Seng Index Futures: Climbing Above the 50-Day SMA Line

rhboskres

Publish date: Tue, 02 Nov 2021, 08:40 AM

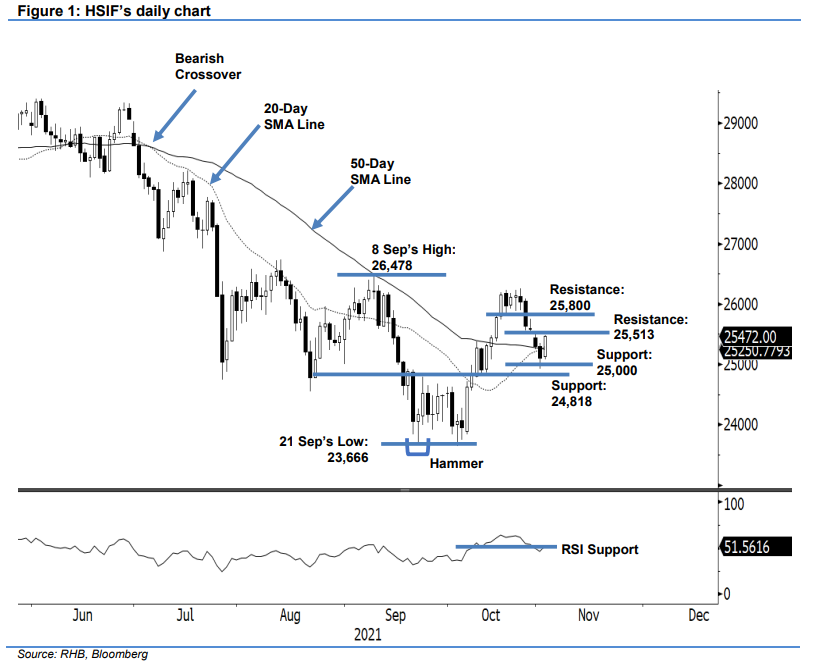

Maintain short positions. The HSIF saw a session of two halves yesterday. The day session initially fell 199 pts to settle at 25,105 pts, while the evening session rose 367 pts to close at 25,472 pts. The latest positive close saw the index printing a candlestick with long lower shadow while bouncing off the 50-day SMA line. We have observed the 20-SMA line managing to cross above the 50-day one – technically, this suggests a medium-term bullish trend is setting in. If the bullish momentum follows through and breaches above the immediate resistance, this will affirm that the HSIF has formed a strong interim base at the 50-day SMA line and is resuming its upward movement. Conversely, falling below the 50-day SMA line will deem that the Bullish Crossover of the moving averages has failed, opening the door for further downside corrections. For now, we maintain a negative trading bias until the stop loss is breached.

We recommend traders maintain the short positions initiated at 25,162 pts, or the closing of 29 Oct’s evening session. To manage the trading risks, the stop-loss threshold is revised to 25,513 pts.

The nearest supports remain at the 25,000-pt round figure and 12 Oct’s low, ie 24,818 pts. The immediate resistance is pegged to 29 Oct’s high – 25,513 pts – with a higher resistance at the 25,800-pt whole number.

Source: RHB Securities Research - 2 Nov 2021