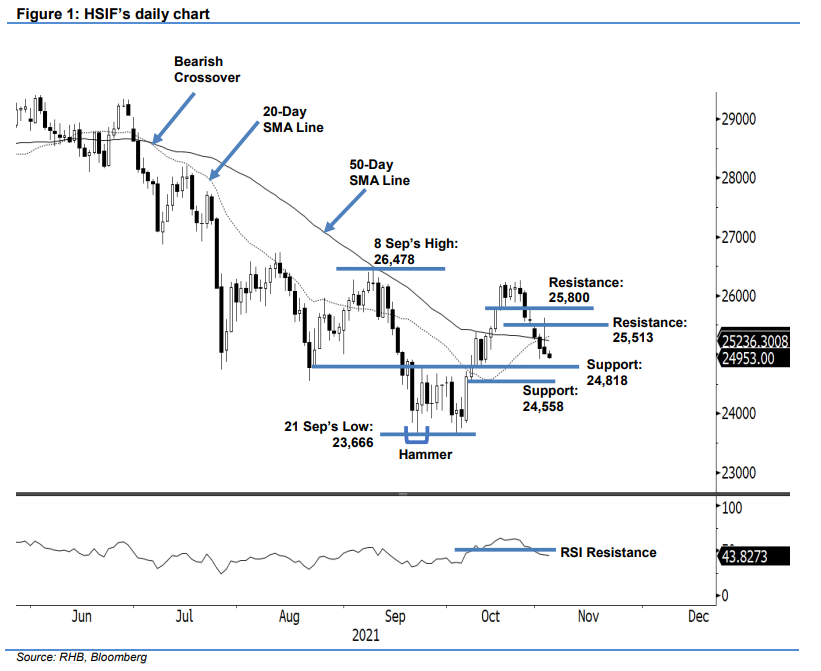

Hang Seng Index Futures: Retreating Below the 50-Day SMA Line

rhboskres

Publish date: Wed, 03 Nov 2021, 05:43 PM

Maintain short positions. The HSIF failed to maintain above the 50-day SMA line, falling 97 pts to settle at 25,008 pts. The index initially started the day’s session stronger at 25,470 pts and rose to test the day’s high of 25,622 pts. Not long after the opening, the bears decide to take profits. The index then experienced strong selling pressure throughout the session, giving up intraday gains to reach the day’s low of 24,997 pts before the close. In the evening session, sentiment continued to be weak where the index retreated 55 pts and last traded at 24,953 pts. Contrary to our expectations, the Bullish Crossover of the 20-day and 50-day SMA lines did not manage to improve market sentiment. Selling pressure continues to persist above the 50-day SMA line, with the moving average line now acting as the resistance. As the RSI has fallen below the 50% threshold again, the negative momentum may drag the index towards the 24,818-pt level. Since the bears still in control, we stick to our negative trading bias.

Traders should hold on to short positions initiated at 25,162 pts, or the closing of 29 Oct’s evening session. To mitigate the trading risks, the stop-loss threshold is set at 25,513 pts.

The nearest support is revised to 24,818 pts (12 Oct’s low), followed by 24,558 pts (8 Oct’s low). The immediate resistance remains at 29 Oct’s high – 25,513 pts – with a higher resistance at 25,800 pts.

Source: RHB Securities Research - 3 Nov 2021