Hang Seng Index Futures: Consolidating Above the Immediate Support

rhboskres

Publish date: Wed, 10 Nov 2021, 07:01 PM

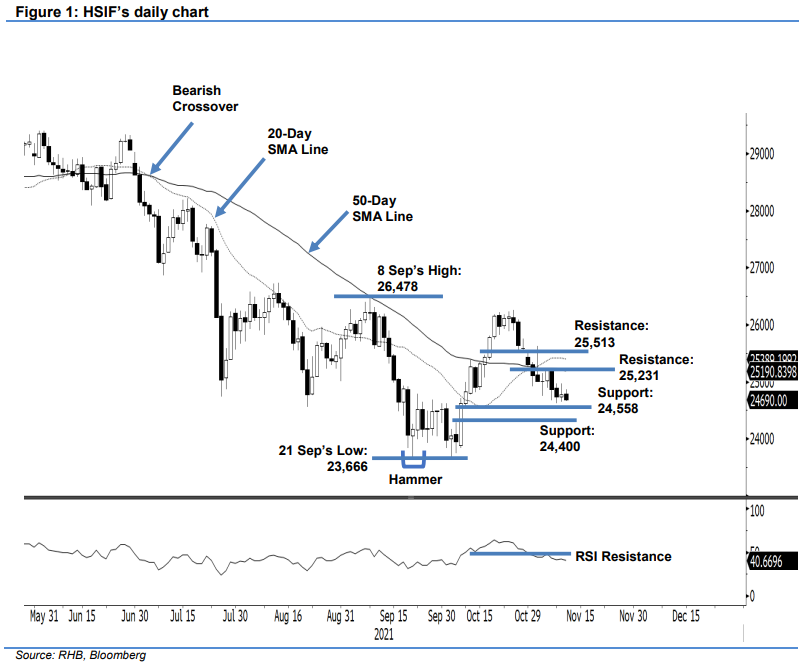

Maintain short positions. The HSIF saw volatility taper yesterday, as it moved sideways above the immediate support. The index rose 42 pts marginally to end Tuesday’s session at 24,779 pts. Initially, the index started off at 24,836 pts. It then climbed to the day’s high of 24,975 pts high before pulling back in the afternoon towards the day’s low of 24,645 pts and settling at 24,779 pts. In the evening, the index dipped 89 pts and last traded at 24,690 pts. As the RSI is moving below the 50% threshold, expect the index to remain in a consolidation mode amid weak momentum. We observe the 20-day SMA line is rounding down – this should add selling pressure to the index. Both the 20-day and 50-day SMA lines are acting as the overhead resistance now. While the index is moving horizontally, we think the downside risk is persisting and hence, we stay with our negative trading bias.

We advise traders to retain the short positions initiated at 25,162 pts, or the closing of 29 Oct’s evening session. To control the trading risks, the stop-loss threshold is set at 25,513 pts.

The nearest support stays at 24,558 pts – 8 Oct’s low – followed by 24,400 pts. On the other hand, the immediate resistance is pegged at 25,231 pts – 4 Nov’s high – followed by 29 Oct’s high, ie 25,513 pts.

Source: RHB Securities Research - 10 Nov 2021