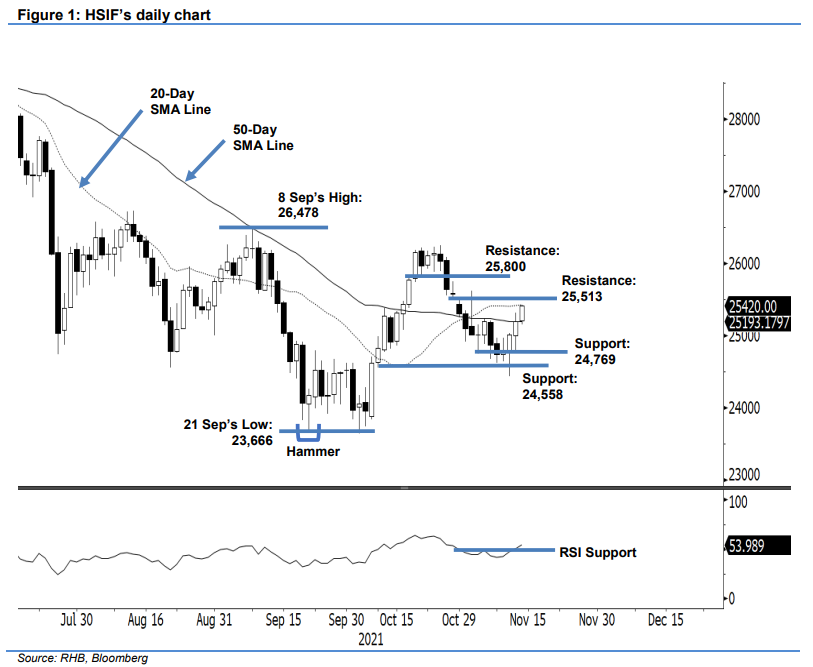

Hang Seng Index Futures: Testing the 20-Day SMA Line

rhboskres

Publish date: Fri, 12 Nov 2021, 04:25 PM

Maintain short positions. The HSIF saw strong bullish momentum emerge yesterday, rising 184 pts to settle at 25,201 pts. Following a rebound in Wednesday’s session, the index initially started off Thursday’s session stronger at 24,817 pts. Although it dipped marginally to the day’s low of 24,769 pts, strong buying interest lifted it to touch the day’s high of 25,315 pts before the positive closing. Meanwhile, the index climbed above the 50-day SMA line during the evening session and last traded at 25,420 pts. The latest session saw market sentiment become risk-on again. To confirm, for the index to return to the path of an upward movement, it has to break past the 25,513-pt resistance, or move above the 20-day SMA line. We expect strong profit taking to happen near the moving average line. Conversely, the 50-day SMA line will act as a support now. Falling below this medium-term moving average line would see the index reverting downwards. As such, we keep to our negative trading bias until the stop-loss is breached.

Traders should retain the short positions initiated at 25,162 pts, or the closing of 29 Oct’s evening session. To minimise the trading risks, the stop-loss is fixed at 25,513 pts.

The immediate support is revised to 24,769 pts – 11 Nov’s low – followed by 24,558 pts, or the low of 8 Oct. The immediate resistance is pegged at 25,513 pts – 29 Oct’s high – followed by 25,800 pts.

Source: RHB Securities Research - 12 Nov 2021