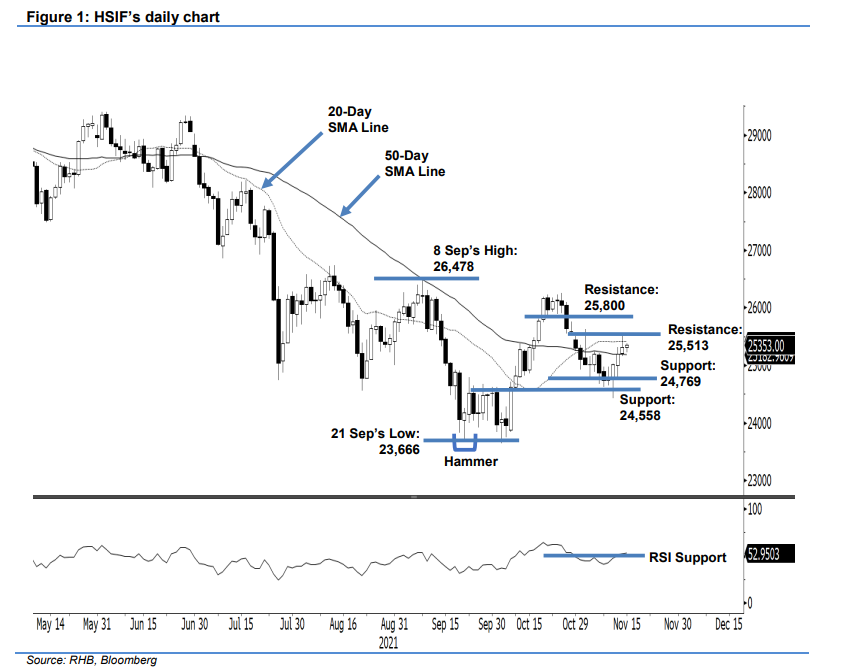

Hang Seng Index Futures: Eyeing to Cross Above the 20-Day SMA Line

rhboskres

Publish date: Mon, 15 Nov 2021, 08:34 AM

Maintain short positions. The HSIF climbed higher amid bullish momentum last Friday, adding 109 pts to settle the day session at 25,310 pts. The index started the session stronger at 25,499 pts. After touching the 25,529-pt day high, it retraced lower on profit-taking, reaching the 25,181-pt day low before the day session closed. During the evening session, the HSIF rose 43 pts and last traded at 25,353 pts. The index has been observed moving higher on the heel of “higher lows” since it staged a technical rebound on 10 Nov. If it is able to cross above the 20-day SMA line, this will attract further buying interest – causing it to lift higher. At this stage, we think selling pressure still persists at the moving average line and it is likely that the HISF will pull back for consolidation before attempting to cross this threshold. Hence, we stick to our negative trading bias until the upside resistance is breached.

Traders should keep to the short positions initiated at 25,162 pts or the closing of 29 Oct’s evening session. For trading-risk management, the stop-loss mark is placed at 25,513 pts.

The immediate support is unchanged at 24,769 pts – 11 Nov’s low – and followed by 24,558 pts, ie the low of 8 Oct. On the upside, the first resistance is eyed at 25,513 pts – 29 Oct’s high – and is followed by 25,800 pts.

Source: RHB Securities Research - 15 Nov 2021