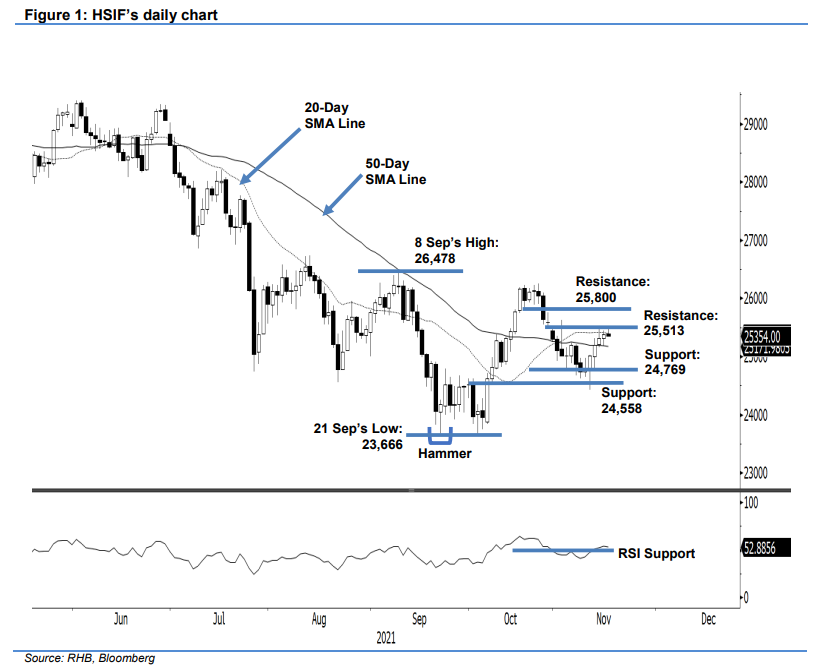

Hang Seng Index Futures: Testing the 20-Day SMA Line

rhboskres

Publish date: Tue, 16 Nov 2021, 08:45 AM

Maintain short positions. Despite mild profit-taking early in the session, the HSIF reversed its intraday losses to climb 66 pts and settle at 25,376 pts. The index opened at 25,382 pts yesterday, and fell to the 25,180-pt session low in the morning, before climbing to close at 25,376 pts in the afternoon. In the evening session, it edged up to touch the 25,474-pt session high, and was last traded at 25,354 pts. As mentioned in our previous note, we think selling pressure will persist at the 20-day SMA line. In the coming session, the index is likely to consolidate below the moving average line. Meanwhile, we observed that the RSI has climbed above the 50% threshold, indicating that bullish momentum has picked up pace in recent sessions. If the index breaches above the moving average line, we expect strong momentum to follow through, resulting in the index crossing the 25,513-pt resistance level. Until then, we will keep our negative trading bias.

Traders are recommended to keep the short positions initiated at 25,162 pts or the closing of 29 Oct’s evening session. To manage trading risks, the stop-loss is set at 25,513 pts.

The immediate support is fixed at 24,769 pts (11 Nov’s low), followed by 24,558 pts (8 Oct’s low). Meanwhile, the nearest resistance is pegged at 25,513 pts – 29 Oct’s high – followed by 25,800 pts.

Source: RHB Securities Research - 16 Nov 2021