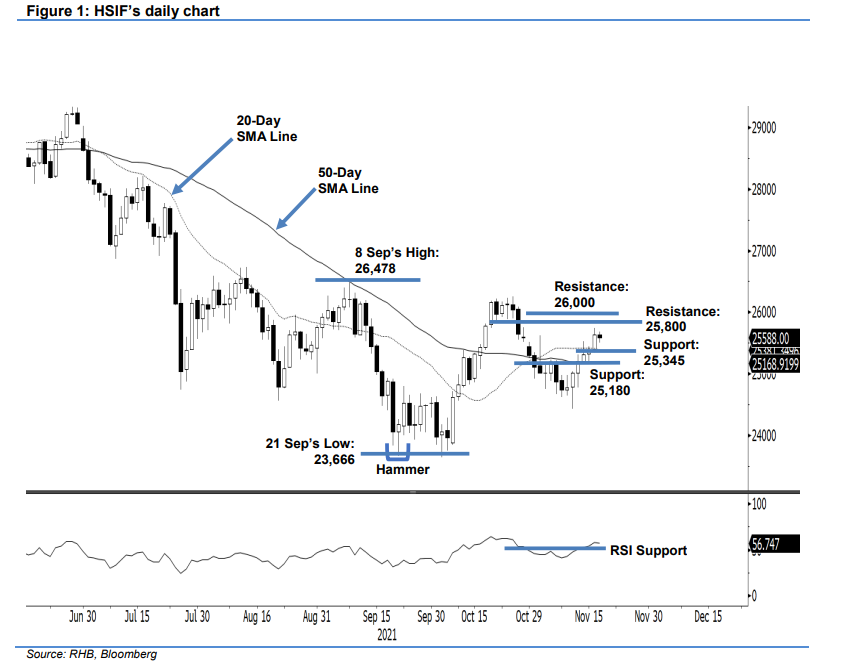

Hang Seng Index Futures: Bullish Momentum Accelerates Above the 20-Day SMA Line

rhboskres

Publish date: Wed, 17 Nov 2021, 04:39 PM

Stop-loss level triggered; initiate long positions. The HSIF rose for a sixth consecutive session yesterday, rising 260 pts to settle at 25,636 pts and breaching the previous 25,513-pt resistance. The index initially opened at 25,367 pts. After barely touching the 25,357-pt session low, it surged towards the 25,745-pt session high and moved sideways for the rest of the session. During the evening session, the HSIF retreated 48 pts and last traded at 25,588 pts. As we expected, once the index crossed above the 20-day SMA line, the strong bullish momentum continued to lift it higher – it is now trading at its 2-week high. After a strong rally, the HSIF may be prone to profit-taking activities, but we believe both the 20- and 50-day SMA lines will provide a strong support. Since the stop-loss mark has been breached, we now shift towards a positive trading bias.

We closed out the short positions initiated at 25,162 pts – the close of 29 Oct’s evening session – after the 25,513-pt stop-loss was triggered. Conversely, we initiate long positions at the closing level of 16 Nov, ie 25,636 pts. To manage the trading risks, initial stop-loss mark is set at 24,900 pts – a level below the 50-day SMA line.

The nearest support is revised to 25,345 pts – 16 Nov’s low – and followed by 25,180 pts, or 15 Nov’s low. On the upside, the immediate resistance is eyed at 25,800 pts and followed by the 26,000-pt round figure.

Source: RHB Securities Research - 17 Nov 2021