WTI Crude: Struggling to Bounce Above the USD80.00 Support

rhboskres

Publish date: Wed, 17 Nov 2021, 04:42 PM

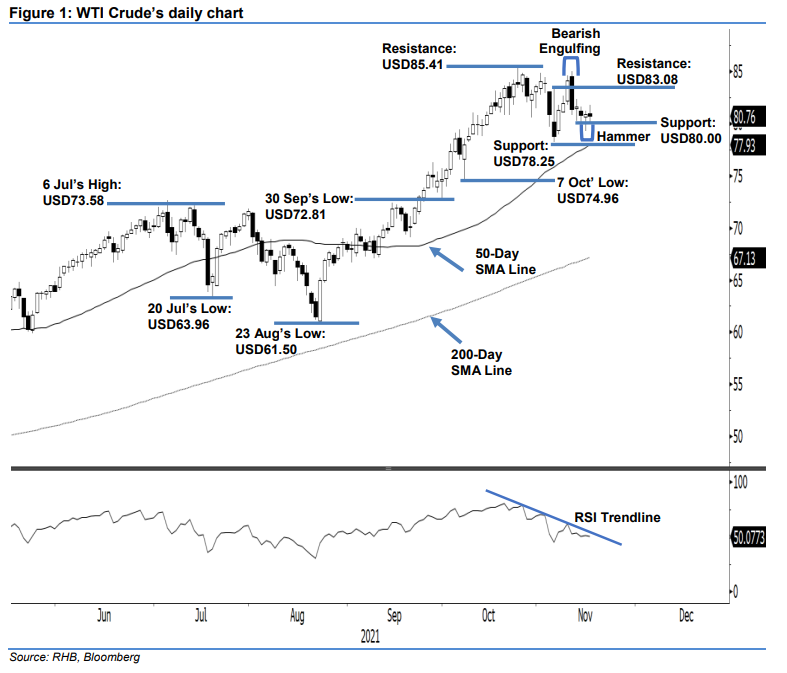

Maintain long positions. The WTI Crude recouped all the intraday gains yesterday to close on a mild negative – it retreated USD0.12 lower to USD80.76 and failed to bounce higher amid a shortlived rebound. The commodity opened with a neutral tone at USD80.93 – it jumped during the Asian trading session to hit the intraday high of USD81.81 before falling sharply during the US trading session towards the USD80.03 intraday low. The WTI Crude then bounced off mildly to close. The black body candlestick with long upper shadow suggests the selling pressure remains intact despite the Hammer candlestick printed during the earlier session. This also signals that the negative momentum may continue further and breach below the USD80.00 support level. Since the stop-loss level has not been triggered, we stick to our positive trading bias.

We recommend traders hold on to the long positions initiated at USD84.15, ie the closing level of 9 Nov. To manage the downside risks, the intital stop-loss threshold is located at USD80.00.

The support levels stay at USD80.00 and USD78.25, or 4 Nov’s low. Conversely, the nearest resistance level is eyed at USD83.08 – 3 Nov’s high – and followed by USD85.41, ie the high of 25 Oct.

Source: RHB Securities Research - 17 Nov 2021