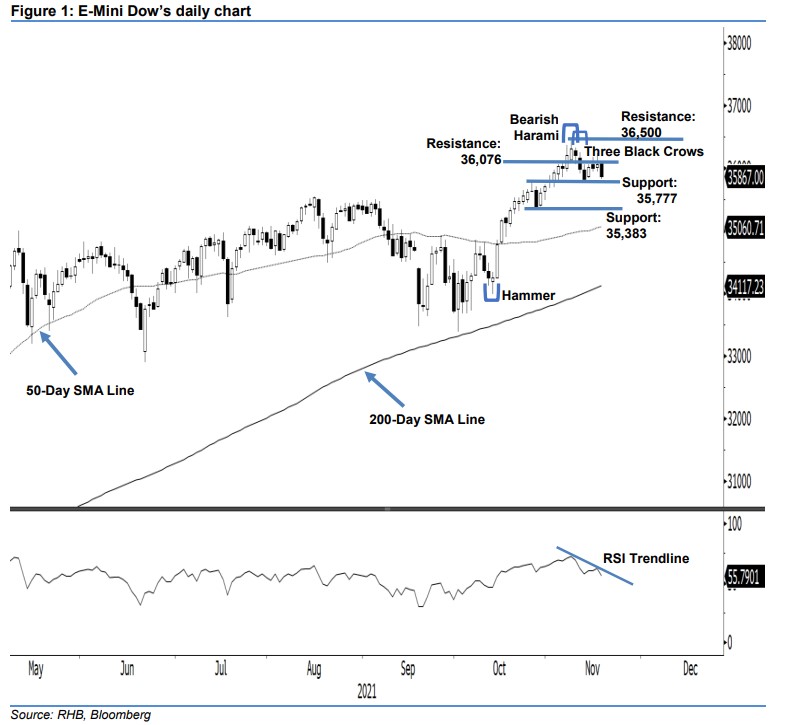

E-Mini Dow: Inching Lower Towards the 35,777-Pt Support

rhboskres

Publish date: Thu, 18 Nov 2021, 06:04 PM

Still short positions. The E-Mini Dow reversed its momentum and turned bearish yesterday after falling strongly by 194 pts to close at 35,867 pts. The index opened mildly positive at 36,074 pts and attempted to move higher to touch the intraday high of 36,105 pts. However, this was shortlived. Selling pressure kicked in following the Asian trading session and lasted until the end of the session. It hit the intraday low of 35,822 pts before closing. The latest long black candlestick reaffirms the negative momentum that appeared from the recent “Three Black Crows” bearish candlestick pattern while printing a “lower high” bearish pattern. With the RSI’s further weakening – pointing lower towards below the 60% level – it is highly likely for the E-Mini Dow to break past the 35,777-pt immediate support in the coming sessions to form a “lower low" bearish structure. As such, we stick to our bearish trading bias.

Traders should keep to the short positions initiated at 35,992 pts or the closing level of 10 Nov. To mitigate the trading risks, the initial stop-loss threshold is placed at 36,500 pts.

The immediate support remains at 35,777 pts – 26 Oct’s high – and is followed by 35,383 pts, ie 27 Oct’s low. Conversely, the nearest resistance is fixed at 36,076 pts – the high of 4 Nov – and followed by 36,500 pts.

Source: RHB Securities Research - 18 Nov 2021