Hang Seng Index Futures: Negative Momentum Accelerates Below the 50-Day SMA Line

rhboskres

Publish date: Mon, 22 Nov 2021, 08:43 AM

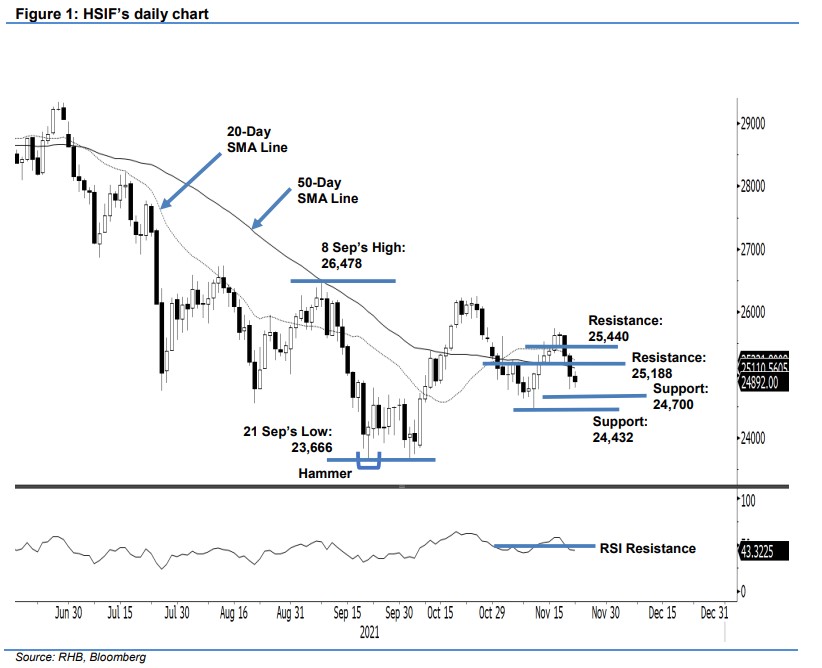

Stop-loss mark triggered; initiate short positions. The HSIF saw the bears still in control last Friday, as it fell 319 pts to settle at 24,989 pts. The index initially began the day session on a cautious sentiment, gapping down and opening at 24,926 pts. After falling to the 24,778-pt day low, it rebounded to close at 24,989 pts. During the evening session, the HSIF failed to establish an interim base and saw renewed selling pressure, retreating 97 pts before last trading at 24,892 pts. The latest session saw the index fell below the 50-day SMA line and breach the 24,900-pt previous support level. The moving average line is trending lower and, coupled with the RSI pointing southwards, both technical indicators signal that the negative momentum will follow through – we expect a “lower low” bearish pattern for the immediate session. We shift to a negative trading bias now, as the stop loss has been breached.

We closed out the long positions initiated at 25,636 pts – the closing level of 16 Nov – after the stop-loss point of 24,900 pts was breached. Conversely, we initiate short positions at the closing level of 19 Nov’s evening session, ie 24,892 pts. To manage the trading risks, an initial stop-loss is placed at 25,500 pts.

The nearest support is revised to 24,700 pts – this is followed by 24,432 pts or 10 Nov’s low. The immediate resistance stays at 25,188 pts – 18 Nov’s low – and is followed by 25,440 pts, ie the high of 15 Nov.

Source: RHB Securities Research - 22 Nov 2021