COMEX Gold: Testing the Immediate Support

rhboskres

Publish date: Mon, 22 Nov 2021, 09:00 AM

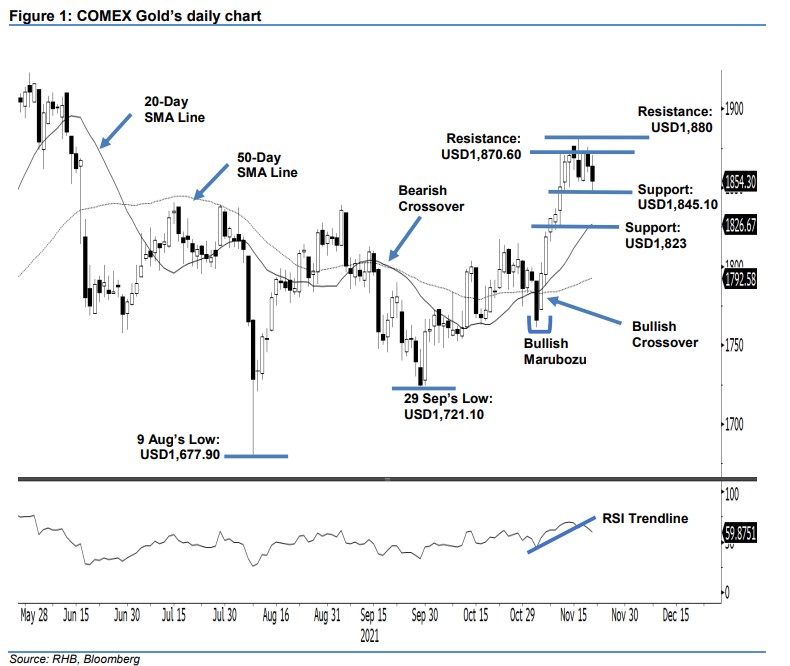

Maintain long positions. The COMEX Gold extended its profit-taking activities last Friday, retracing USD9.70 to settle at USD1,854.30. The precious metal opened the session at USD1,863.80. Although it faced selling pressure, the commodity jumped during the US trading session – surging to test the USD1,870.50 intraday high before resuming its downward path to reach the USD1,847 day low. It closed at USD1,854.30. The latest session saw the COMEX Gold concluding the week in negative territory, marking its first weekly loss after breaking past the USD1,800 barrier in early November. For the immediate session, the commodity may consolidate along the USD1.845.10 immediate support. If this threshold gives way, we may see further downward corrections toward the USD1,823 level, ie the 20-day SMA line. As long as the immediate support stays intact, we regard the recent pullback as a mild consolidation and stick to our positive trading bias.

Traders should stick with the long positions initiated at USD1,793.50 or the closing level of 4 Nov. To mitigate the downside risks, the trailing-stop threshold is placed at USD1,845.

The immediate support remains at USD1,845.10 – 11 Nov’s low – and followed by USD1,823, ie 10 Nov’s low. The nearest resistance is kept at USD1,870.60 – 10 Nov’s high – and the USD1,880 whole number.

Source: RHB Securities Research - 22 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024