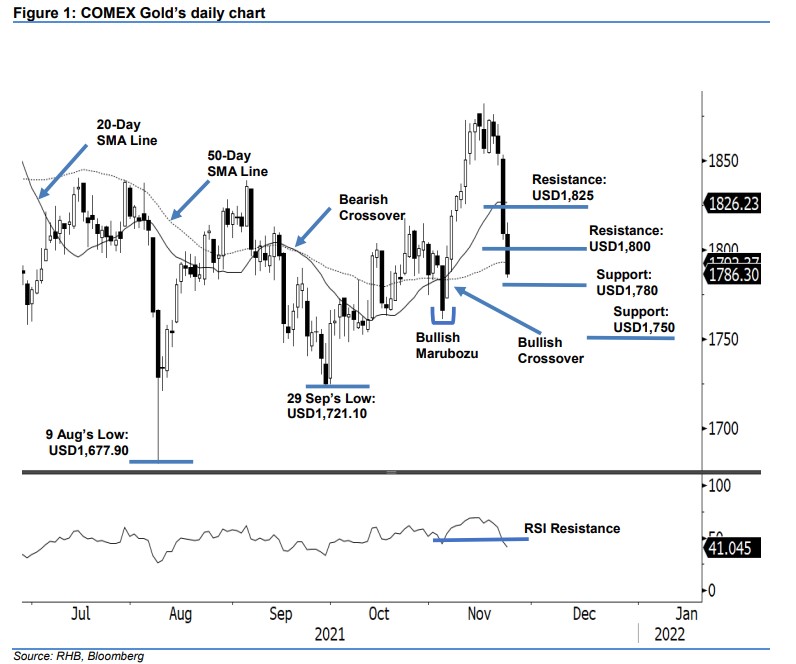

COMEX Gold: Falling Below the USD1,800 Psychological Level

rhboskres

Publish date: Wed, 24 Nov 2021, 04:43 PM

Maintain short positions. The COMEX Gold extended its correction on Tuesday, declining USD22.80 to settle at USD1,786.30. The commodity started off at USD1,808.70. Although brief momentum during the early session lifted it towards the USD1,815.20 session high, strong selling pressure during the European trading hours dragged it towards the USD1,784.30 session low – it closed weaker at USD1,786.30. The COMEX Gold has failed to establish its support near the USD1,800 mark and may attempt to find its interim base near the 20-day SMA line. We expect to see some sideways movements along the short-term moving average line in the coming sessions. If the USD1,780 support gives way, the yellow metal may travel southwards to test the USD1,750 level. For now, we maintain our negative trading bias.

We recommend traders keep to the short positions iniitated at USD1,809, or the closing level of 22 Nov. To mitigate the trading risks, the stop-loss threshold is revised to USD1,830 from USD1,835.

The immediate support is revised to USD1,780 and followed by the USD1,750 whole number. Conversely, the immediate resistance is eyed at the USD1,800 round number, followed by USD1,825.

Source: RHB Securities Research - 24 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024