Hang Seng Index Futures: Attempts to Stay Above the Immediate Support

rhboskres

Publish date: Fri, 26 Nov 2021, 05:48 PM

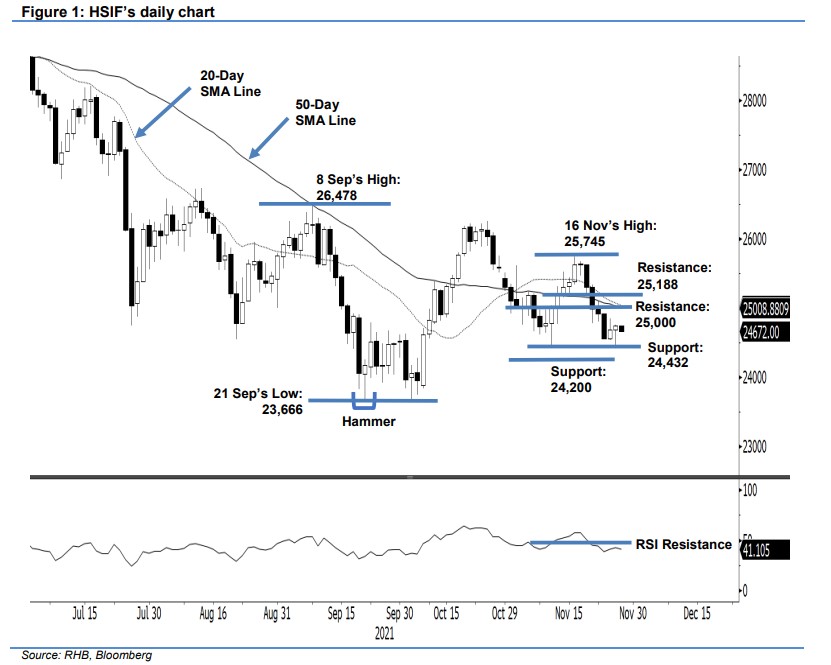

Maintain short positions. The HSIF attempted to form an interim base near the immediate support on Thursday, rebounding 58 pts to settle the day session at 24,746 pts. In the morning, the index initially began at 24,696 pts. It fell to the 24,510-pt day low and rebounded towards the 24,765-pt day high before the close. During the evening session, it pulled back 74 pts and last traded at 24,672 pts. The latest session showed that the HSIF is attempting to consolidate and form its interim base near the 24,432-pt immediate support. If it sustains above this threshold, the index may climb higher to re-test the 50-day SMA line. As mentioned in our previous note, we think the downtrending moving average line is pressurising the HSIF to move lower. Hence, post consolidation, we expect the index to resume its downwards movement. As such, we still hold on to our negative trading bias.

Traders are recommended to keep the short positions initiated at 24,892 pts, ie the closing level of 19 Nov’s evening session. To manage the trading risks, the stop-loss mark is set at 25,188 pts.

The immediate support remains at 24,432 pts – 10 Nov’s low – and is followed by the lower support at 24,200 pts. Conversely, the immediate resistance stays at the 25,000-pt round figure and is followed by 25,188 pts, ie the low of 18 Nov.

Source: RHB Securities Research - 26 Nov 2021