E-Mini Dow: Rebounding Moderately Towards the 50-Day SMA Line

rhboskres

Publish date: Tue, 30 Nov 2021, 08:38 AM

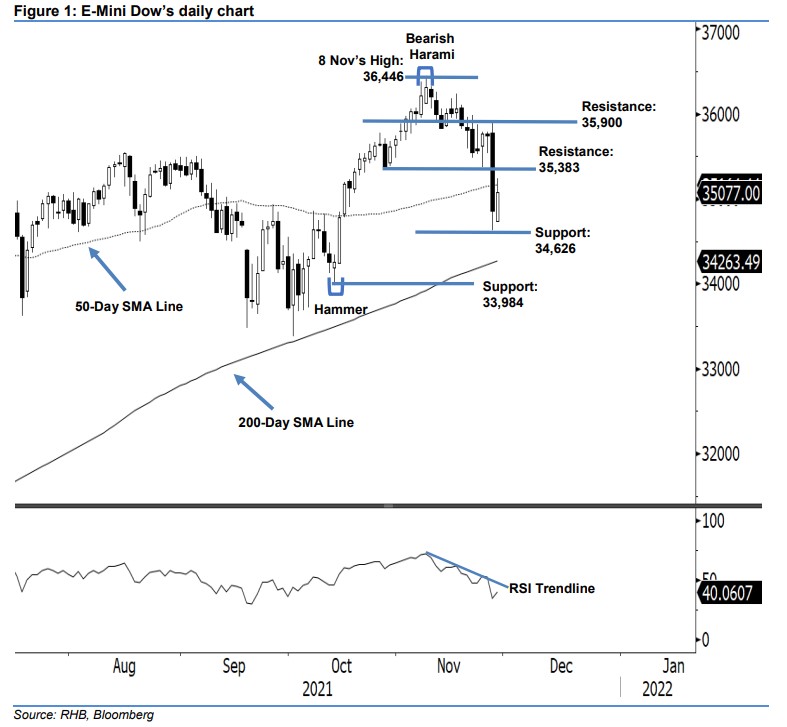

Maintain short positions. The E-Mini Dow reversed to positive momentum yesterday, as it bounced off and attempted to reclaim the territory above the 50-day average line. It closed 219 pts higher at 35,077 pts. While the index started lower at 34,741 pts, buying pressure emerged immediately and persisted throughout the session to propel the index higher. It whipsawed positively to hit the day’s high of 35,246 pts during the US trading session. It then retraced ahead of a mild rebound, before closing at 35,007 pts. The latest positive candlestick with upper shadow shows that the bulls are attempting to pause the bears’ movement. However, we expect bullish momentum to be short-lived, as it failed to reclaim the 50-day average line, and is still forming a “lower high” bearish formation. We still see the downtrend persisting towards the 200-day SMA line in the medium term. Unless the bulls persist and breach the trailing-stop threshold, we will stick to our bearish trading bias.

Traders are recommended to stay in the short positions initiated at 35,992 pts – the closing level of 10 Nov. To manage trading risks, the initial trailing-stop is marked at 35,383 pts.

The immediate support is placed at 34,626 pts, or 26 Nov’s low, followed by the 33,984-pt round figure, or 13 Oct’s low. The immediate resistance is still at 35,383 pts, or 27 Oct’s low, followed by 35,900 pts.

Source: RHB Securities Research - 30 Nov 2021