WTI Crude: Bouncing Off the 200-Day SMA Line

rhboskres

Publish date: Tue, 30 Nov 2021, 08:39 AM

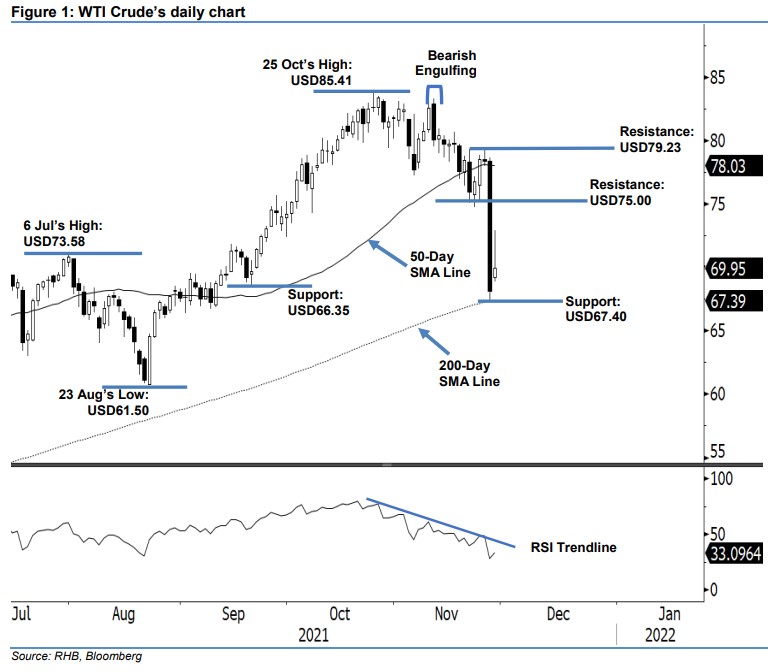

Maintain short positions. The WTI Crude pared some of its strong intraday gains amid a positive rebound yesterday, closing USD1.80 higher at USD69.95 – and retracing from the day’s peak of USD72.93. It opened stronger at USD69.23 and rose to the day’s USD72.93 high at the start of the US trading session. Selling pressure then emerged to drag the commodity below its opening level, touching the day’s low of USD68.86 before rebounding moderately to reclaim the territory above its opening price, and close on a positive note. The latest white body candlestick with a long upper shadow suggests that selling pressure still dominates the direction in the medium term – in line with our views in our previous note. We expect the WTI Crude to hover between the USD75.00 resistance and USD67.40 support levels in the immediate term. With the weakening RSI near the 30% level, we expect more downside in the medium term, if it falls below the average line. We maintain our negative trading bias.

Traders should keep the short positions initiated at USD78.36, or the closing level of 17 Nov. To mitigate trading risks, the stop-loss threshold is pegged at USD80.00 or above 50-day SMA line.

The immediate support is placed at USD67.40, or 26 Nov’s low, followed by USD66.35, which was 1 Sep’s low. The closest resistance is eyed at the USD75.00 whole number, followed by USD79.23 – 24 Nov’s high.

Source: RHB Securities Research - 30 Nov 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024