E-Mini Dow: Bears Breaching Below the 200-Day SMA Line

rhboskres

Publish date: Thu, 02 Dec 2021, 05:41 PM

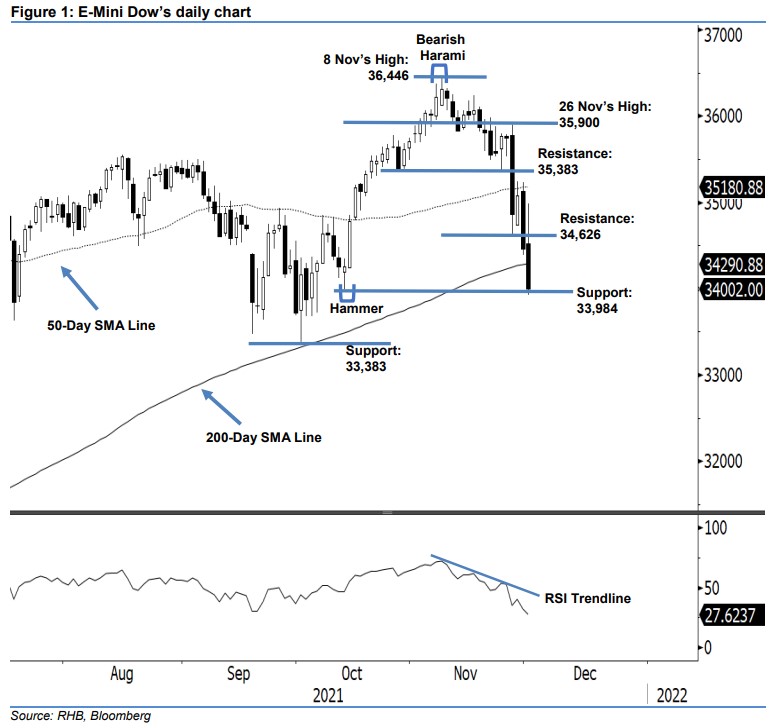

Keep short positions. The E-Mini Dow continued with another strong decline yesterday, writing-off the intraday gains as it fell 455 pts to settle at 34,002 pts – crossing below the 200-day average line. It began higher at 34,524 pts and gradually moved northwards until the mid-US trading session to touch the day’ peak at 34,986 pts. Bearish momentum then emerged to shift the direction southwards, which saw the index fall strongly below the opening level at the close. It hit the 33,928-pt day’s bottom before closing. The latest long black candlestick with long upper shadow suggests that selling pressure is set to persist below the 200-day average line. We expect the E-mini Dow to cross further below the immediate support level of 33,984 pts before falling towards the 33,383-pt support, supported by a weakening RSI below the 30% level. Premised on this, we stick to our negative trading bias.

We suggest traders maintain the short positions initiated at 35,992 pts, ie the closing level of 10 Nov. To manage the trading risks, the initial trailing-stop point is set at 35,383 pts, ie above the 50-day average line.

The immediate support is eyed at 33,984 pts – 13 Oct’s low – and followed by 33,383 pts, ie 1 Oct’s low. The immediate resistance is fixed at 34,626 pts – 26 Nov’s low – and followed by 35,383 pts, ie 27 Oct’s low.

Source: RHB Securities Research - 2 Dec 2021