E-Mini Dow: Bulls Re-Emerge to Rebound Above the 200-Day SMA Line

rhboskres

Publish date: Fri, 03 Dec 2021, 04:46 PM

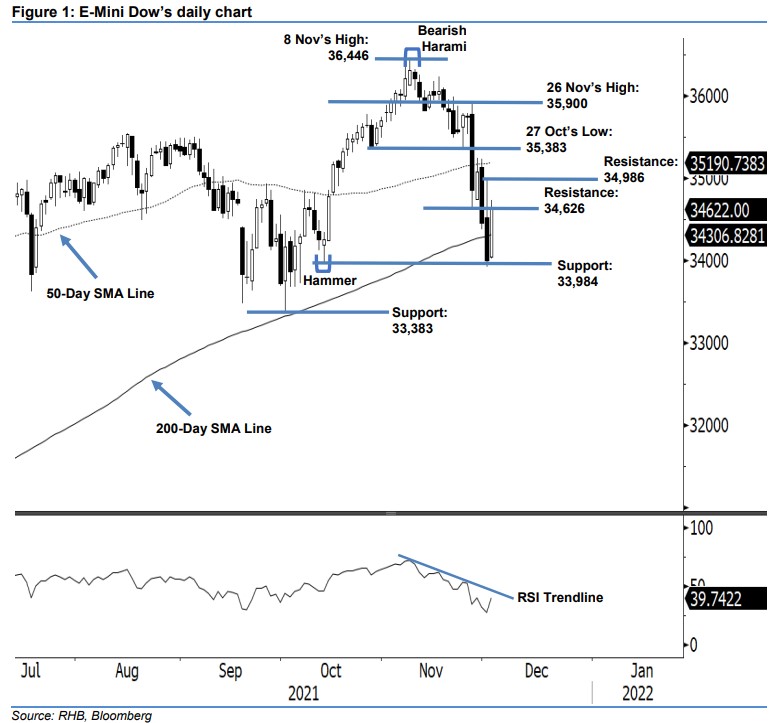

Still short positions. The E-Mini Dow rebounded strongly yesterday as it closed 620 pts stronger at 34,622 pts – breaching above the 200-day average line. It opened slightly higher at 34,050 pts and merely touched the intraday low of 34,018 pts before immediately moving northwards throughout the session. The index reached its day’s peak at 34,738 pts before retracing mildly at the close. The latest long white candlestick suggests that buying pressure has emerged at the immediate support level, which propelled the E-Mini Dow above the long-term average line. With this, we expect the positive momentum to persist in the immediate term towards the 34,986-pt resistance. The medium term still remains bearish – as long as the trailing-stop point is not breached. Premised on this, we maintain our negative trading bias.

We suggest traders keep to the short positions initiated at 35,992 pts, ie the closing level of 10 Nov. To manage the trading risks, the initial trailing-stop point is pegged at the 34,986-pt resistance.

The immediate support is still at 33,984 pts – 13 Oct’s low – and followed by 33,383 pts, or 1 Oct’s low. The immediate resistance is fixed at 34,626 pts – 26 Nov’s low – and followed by 34,986 pts, ie 1 Dec’s high.

Source: RHB Securities Research - 3 Dec 2021