E-Mini Dow: Staying Above the 200-Day SMA Line

rhboskres

Publish date: Mon, 06 Dec 2021, 08:35 AM

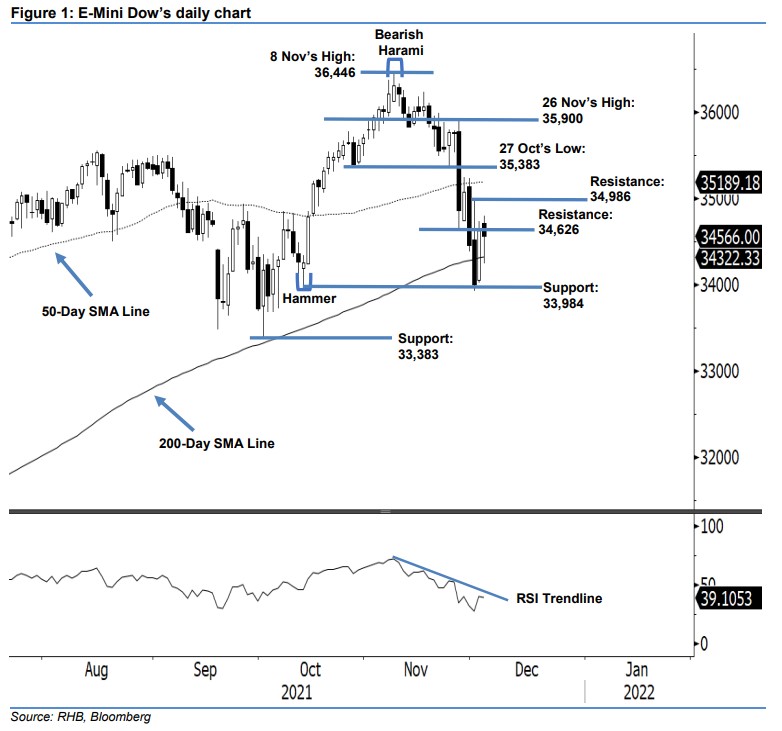

Still short positions. The E-Mini Dow managed to sustain above the long-term average line on Friday, despite closing 56 pts lower at 34,566 pts – it attempted to cross below the average line but rebounded strongly during the intraday session. The index opened higher at 34,715 pts and oscillated sideways towards the early part of the US trading session, during which it hit the day’s high of 34,795 pts. Selling pressure then kicked in to swiftly change its direction, with the index moving to the intraday low of 34,247 pts before strong buying momentum re-emerged to bounce off strongly ahead of the 34,566-pt close. The latest black body candlestick with long lower shadow suggests that buying momentum has emerged above the 200-day average line. Therefore, we expect positive momentum to continue in the immediate term, towards the 34,626-pt immediate resistance. Nevertheless, the medium term remains bearish, as the trailing-stop of 34,986 pts has not been triggered. We keep our negative trading bias.

We suggest traders maintain the short positions initiated at 35,992 pts, or the closing level of 10 Nov. To manage trading risks, the initial trailing-stop is set at the 34,986-pt resistance.

The immediate support is pegged at 33,984 pts – 13 Oct’s low – followed by 33,383 pts, or 1 Oct’s low. The immediate resistance is eyed at 34,626 pts – 26 Nov’s low –followed by 34,986 pts, or 1 Dec’s high.

Source: RHB Securities Research - 6 Dec 2021