WTI Crude: Struggling to Move Above the 200-Day SMA Line

rhboskres

Publish date: Mon, 06 Dec 2021, 08:35 AM

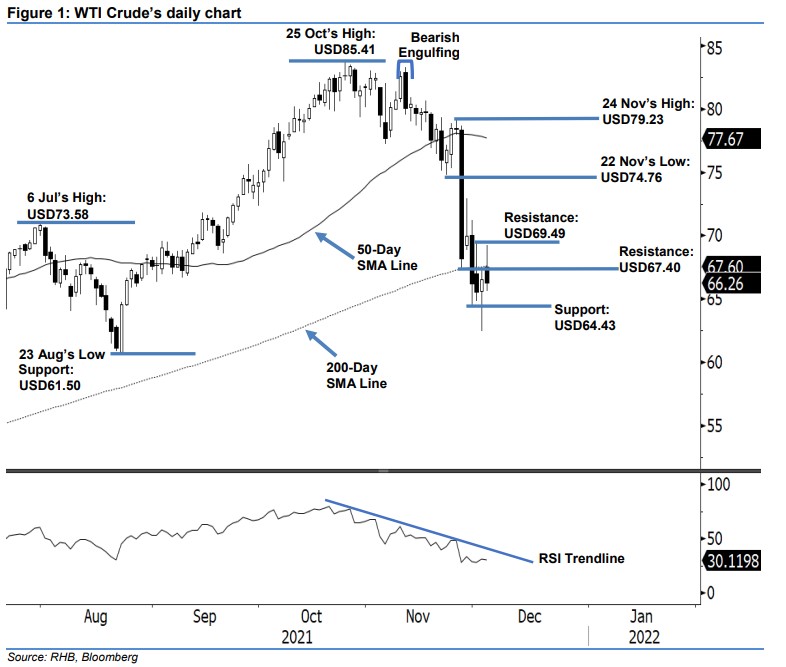

Maintain short positions. The WTI Crude failed to rebound yesterday, losing its intraday gains to close USD0.24 weaker at USD66.26 – below the 200-day average line. It opened at USD67.50 and gradually moved higher, hitting the day’s USD69.22 high during the early hours of the US trading session. Selling pressure then appeared to shift the index’s direction towards the intraday low of USD65.60 before rebounding mildly to close. The latest black body candlestick with long upper shadow – which failed to breach the 200-day SMA line – indicates that selling pressure remains intact in the immediate and medium term, below the USD67.40 resistance. We expect the re-emergence of negative momentum to continue towards the USD64.43 support level in the immediate term. Unless the momentum reverses, and the index breaches the trailing-stop, we will stick to our bearish trading bias.

Traders should keep the short positions initiated at USD78.36 or the closing level of 17 Nov. To manage trading risks, the initial trailing-stop threshold is set at the USD69.49 resistance.

The immediate support is still at USD64.43 – 30 Nov’s low – followed by USD61.50, which was 23 Aug’s low. The nearest resistance is pegged at USD67.40 – 26 Nov’s low – followed by USD69.49, or 1 Dec’s high.

Source: RHB Securities Research - 6 Dec 2021