COMEX Gold: Mild Rebound; Still Below the 50-Day SMA Line

rhboskres

Publish date: Mon, 06 Dec 2021, 08:37 AM

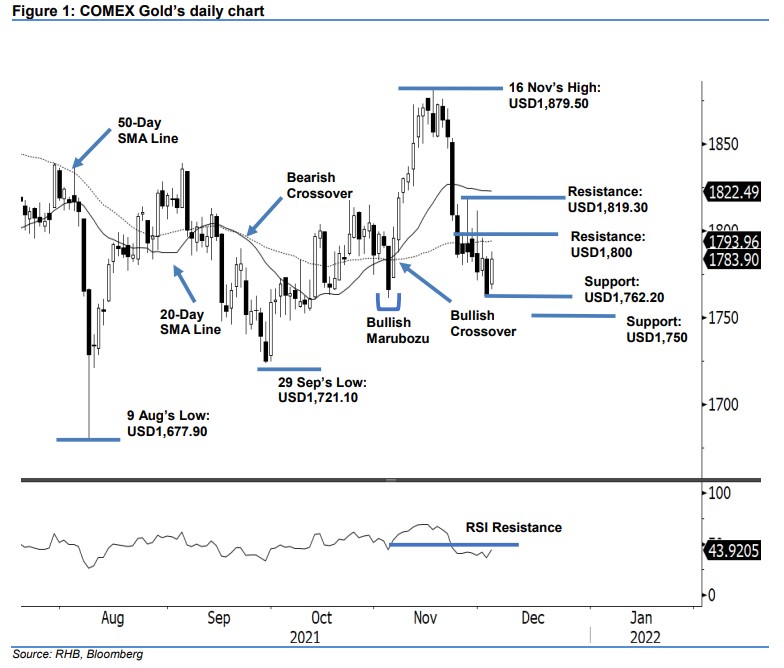

Maintain short positions. The COMEX Gold staged a mild rebound last Friday, climbing USD21.20 to settle at USD1,783.90 – still trading below the 50-day SMA line. Initially, the yellow metal began at USD1,783.80 and progressed upwards. Volatility picked up during the US trading hour, where the commodity whipsawed and fell to the session’s low of USD1,766. It then pared its intraday losses, rebounding to test the session’s high of USD1,788 before the close. The latest session saw the bears stage a rebound from the immediate support, hence, the Bullish Marubozu that formed on 4 Nov remains valid. Still, we think the rebound may not able to extend further as strong selling pressure may exist near the USD1,800-pt level. As long as the commodity stays below the 50-day SMA line, it is prone to a downside correction. Premised on this, we keep to our negative trading bias.

We recommend traders to hold on the short positions initiated at USD1,809, or the closing level of 22 Nov. To mitigate the trading risks, the stop-loss threshold is set at USD1,825 – a level above the 20-day SMA line.

The immediate support is revised to USD1,762.20 (2 Dec’s low), followed by USD1,750. The immediate resistance remains pegged at the USD1,800 round number, followed by USD1,819.30, or the high of 26 Nov.

Source: RHB Securities Research - 6 Dec 2021