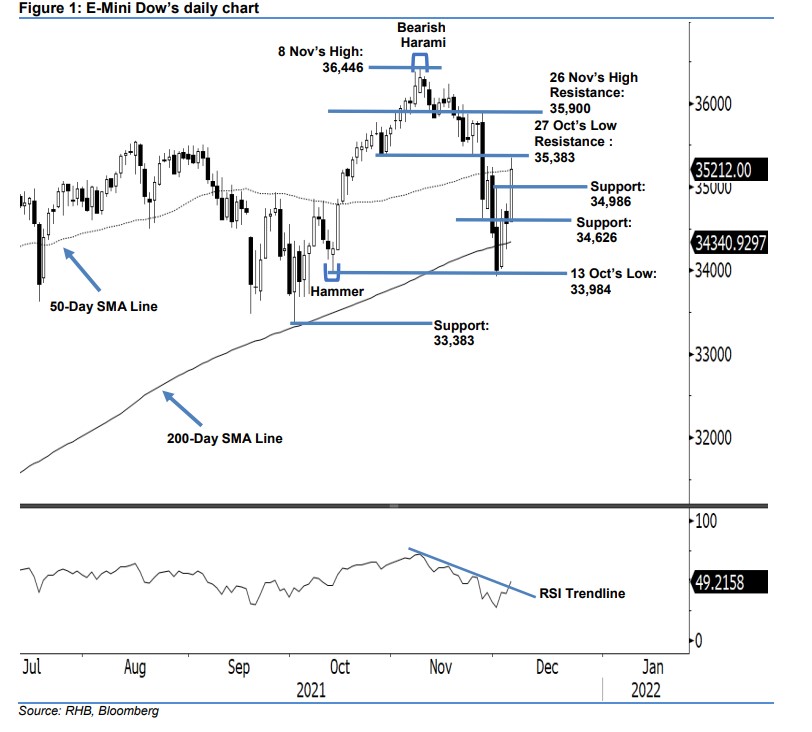

E-Mini Dow: Rebounding Higher Towards the 50-Day SMA Line

rhboskres

Publish date: Tue, 07 Dec 2021, 08:30 AM

Trailing-stop triggered; initiate long positions. The E-Mini Dow rebounded strongly yesterday as it climbed 646 pts to settle at 35,212 pts – breaching past the immediate resistance (also its trailing-stop) while attempting to move past the 50-day average line. The index opened higher at 34,590 pts and merely touched the day’s low of 34,581 pts before propelling northwards throughout the session. It retraced mildly during the European trading session before rebounding stronger to hit the day’s peak of 35,344 pts prior to the closing. The latest long white body candlestick suggests that the recent buying momentum near the 200-day average line has persisted to propel the index higher. We expect the E-mini Dow to move in a positive direction towards breaching above the 50-day SMA line in the coming sessions – supported by the strengthening of the RSI towards near the 50% level. Since the trailing-stop has been breached, we shift to a positive trading bias.

We closed out our short positions, initiated at 35,992 pts, or the closing level of 10 Nov, after the trailing-stop at 34,986 pts was triggered. Conversely, we initiate long positions at the closing level of 6 Dec at 35,212 pts. To manage trading risks, the initial stop-loss is set at the 34,626-pt support.

The immediate support is pegged at 34,986 pts – 1 Dec’s high – followed by 34,626 pts, or 26 Nov’s low. The immediate resistance is eyed at 34,383 pts – 27 Oct’s low – followed by 35,900 pts, or 26 Nov’s high.

Source: RHB Securities Research - 7 Dec 2021