WTI Crude : Rebounding Above the Immediate Resistance

rhboskres

Publish date: Wed, 08 Dec 2021, 05:54 PM

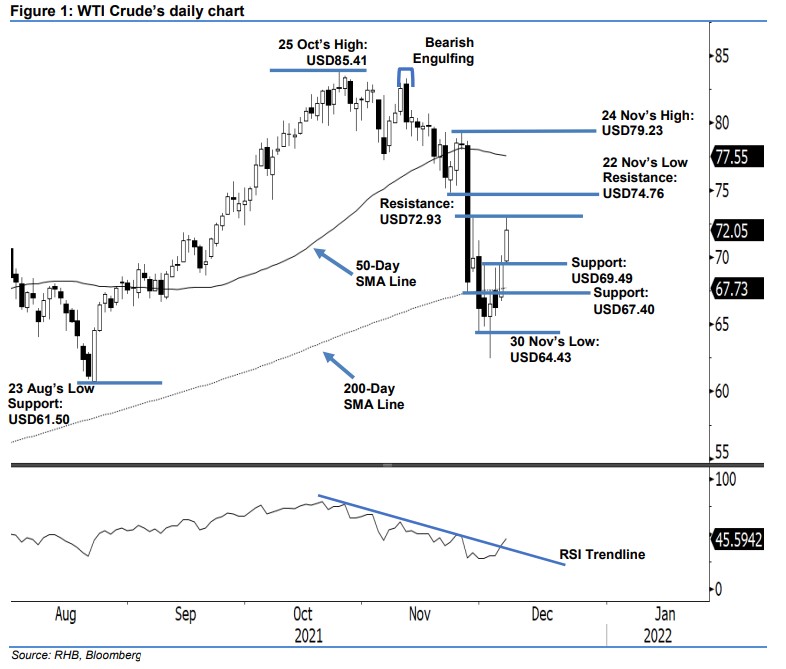

Trailing-stop triggered; initiate long positions. The WTI Crude jumped higher yesterday, as it climbed USD2.56 to settle at USD72.05 – rising significantly above the immediate resistance or trailing-stop level. It opened on a positive note at USD69.72 and touched the day’s low of USD69.52 before gradually rising to the day’s high of USD73.03 halfway through the US trading session. It then retraced mildly towards the close. The white body candlestick formed – for two consecutive sessions – suggests that the uptrend reversal is becoming more evident for the index to move higher in the coming sessions, in line with our earlier expectation. We expect the commodity to rebound strongly beyond the USD72.93 resistance in the coming sessions. As the trailing-stop was breached, we shift to a positive trading bias.

We closed out our short positions – initiated at USD78.36, or the closing level of 17 Nov – after the trailing-stop at USD69.49 was triggered. Conversely, we initiate long positions at the closing level of 7 Dec, or USD72.05. To manage trading risks, the initial stop-loss threshold is introduced at the USD67.40 support level.

The immediate support is fixed at USD69.49 – 1 Dec’s high – followed by USD67.40, which was 26 Nov’s low. The nearest resistance is set at USD72.93, or 29 Nov’s high, followed by USD74.76, which was 22 Nov’s low.

Source: RHB Securities Research - 8 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024