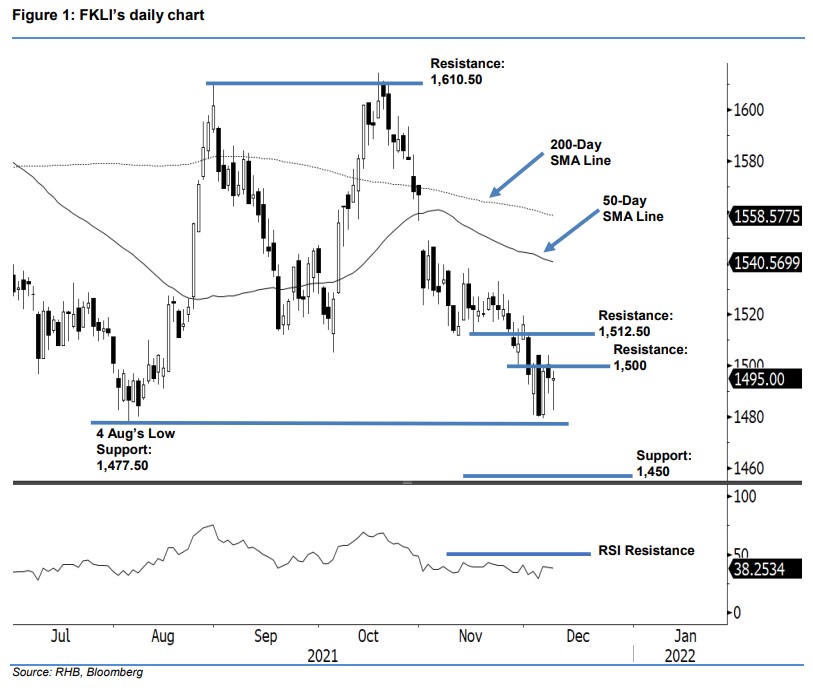

FKLI: Downtrend Remains Below 1,500-Pt Resistance

rhboskres

Publish date: Fri, 10 Dec 2021, 05:08 PM

Maintain short positions. The FKLI continued its selling momentum below 1,500 pts yesterday as it closed 0.5 pts lower at 1,495 pts – it recouped losses strongly from the intraday low of 1,482.5 pts. The index opened at 1,494.5 pts during the early session, then trended south to the intraday low during the morning session, before bouncing off above the opening towards the day’s high of 1,498 pts. It underwent a mild retracement before closing. Despite buying pressure emerging from the day’s bottom yesterday, the FKLI is expected to trend lower as it has yet to form a “higher high” bullish structure – on top of failing to breach the immediate resistance of 1,500 pts. Coupled with the RSI trending below the 50% threshold while the index stays below the psychological level, sentiment should remain negative. Hence, we stick to a negative trading bias until the stop-loss has been breached.

We advise traders to stay in short positions, which were initiated at 1,496.50 pts or the close of 1 Dec. To minimise the trading risks, the stop-loss is set at 1,517 pts.

The immediate support remains at 1,477.50 pts or the low of 4 Aug, then 1,450 pts. Conversely, the immediate resistance is at 1,500 pts, then 1,512.50 pts (1 Dec’s high).

Source: RHB Securities Research - 10 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024