Hang Seng Index Futures: Bears Testing the Immediate Support

rhboskres

Publish date: Wed, 15 Dec 2021, 06:03 PM

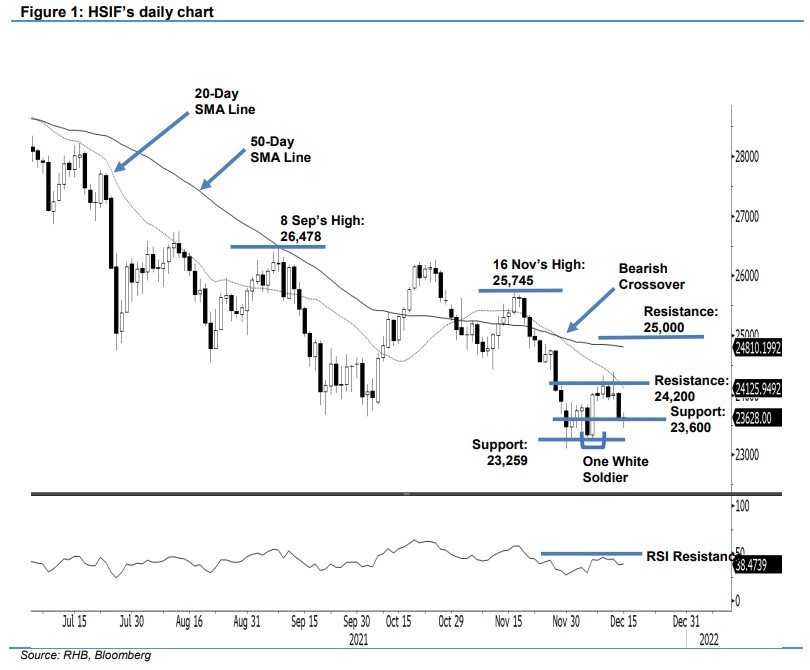

Maintain short positions. The HSIF experienced strong selling pressure yesterday, falling 419 pts to settle the day session at 23,598 pts. The index started the session weaker at 23,670 pts and rebounded to touch the 23,813-pt session high. It then turned lower, reaching the session’s 23,552-pt low before the close. After a sharp correction, it recouped 30 pts during the evening session, and last traded at 23,628 pts. From this session, mild buying interest was seen near the immediate support level of 23,600 pts. The index may attempt to establish an interim base near this level. However, if this threshold is breached, we expect strong selling pressure to emerge. Meanwhile, the 20- day SMA line is trending lower, and intersecting with the 24,200-pt level – indicating that the immediate resistance has been strengthened. For now, we hold on to our negative trading bias.

Traders should retain the short positions initiated at 24,892 pts, or the closing level of 19 Nov’s evening session. To manage trading risks, the trailing-stop is pegged at the immediate resistance of 24,200 pts.

The immediate support remains at 23,600 pts, followed by 23,259 pts or 1 Dec’s low. Meanwhile, the nearest resistance stays at 24,200 pts, followed by the 25,000-pt round figure.

Source: RHB Securities Research - 15 Dec 2021