E-Mini Dow: Selling Pressure Persisting Towards Immediate Support

rhboskres

Publish date: Wed, 15 Dec 2021, 06:05 PM

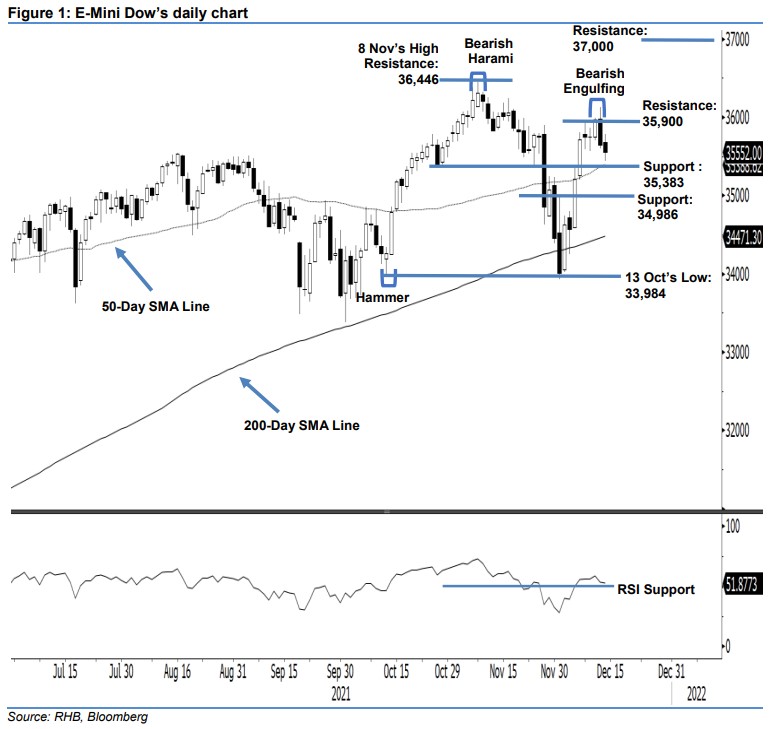

Maintain long positions. The E-Mini Dow continued its negative momentum yesterday, dropping 93 pts to close at 35,552 pts – slightly above the 35,383-pt immediate support. It opened at 35,680 pts and moved in a highly volatile manner throughout the session, between the 35,785-pt high and 35,437-pt low. It moved sideways ahead of the European trading session, which then saw selling pressure kick in to drag the index down in a whipsaw motion towards the day’s low. It rebounded moderately towards the close. The black body candlestick, following the recent “Bearish Engulfing” candlestick, suggests that the immediate term selling momentum remains intact – heading towards the 35,383-pt support, which is also its trailing stop. If the support is breached, the medium-term direction will shift southwards. We still see the selling pressure as a sign of strong profit-taking in the coming sessions before bouncing off above the immediate support. Unless the trailing stop is breached, we will stick with our positive trading bias.

We suggest traders keep the long positions initiated at 35,212 pts. For risk management, the initial trailing-stop is eyed at 35,383 pts.

The immediate support is fixed at 35,383 pts – 27 Oct’s low – followed by 34,986 pts, or the high of 1 Dec. The immediate resistance levels are still at 35,900 pts – 26 Nov’s high – and 36,446 pts, or 8 Nov’s high.

Source: RHB Securities Research - 15 Dec 2021