WTI Crude: the Black Gold May Have Found Its Footing

rhboskres

Publish date: Thu, 16 Dec 2021, 05:18 PM

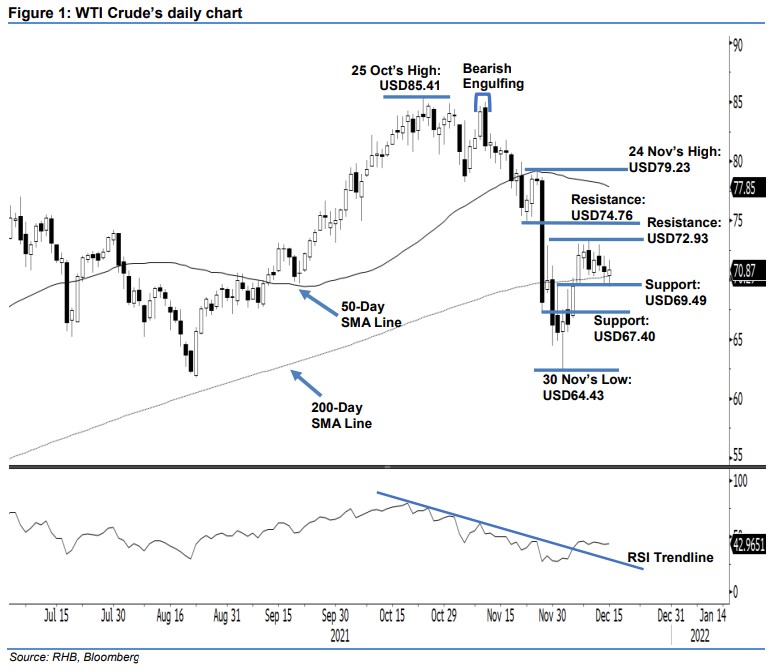

Maintain long positions. The WTI Crude recouped all its intraday losses to bounce higher yesterday after closing USD0.14 higher at USD70.87 – it bounced off strongly from its immediate support to close above the 200-day average line. The black gold opened at USD70.35 and whipsawed in a negative direction towards the mid-US trading session – touching the day’s bottom at USD69.39. Strong buying momentum was then observed, which propelled the WTI Crude towards the USD71.66 intraday high before it retraced towards the close. The latest white body candlestick – where its lower shadow touched the immediate support for two consecutive sessions – reaffirms our previous expectations that the downside is limited. This means the commodity has found its footing above the support level. Therefore, we expect a continuation of the positive momentum to be observed towards the USD72.93 immediate resistance in the coming sessions. Unless the momentum reverses and triggers the stop-loss point, the positive trading bias remains relevant.

We recommend traders stick to the long positions initiated at USD72.05, ie the closing level of 7 Dec. To manage the downside risks, the initial stop-loss threshold is pegged at USD67.40, or below the 200-day average line.

The immediate support is still at USD69.49 – 1 Dec’s high – and followed by USD67.40, ie the low of 26 Nov. The nearest resistance is set at USD72.93 – 29 Nov’s high – and followed by USD74.76, or 22 Nov’s low.

Source: RHB Securities Research - 16 Dec 2021

.png)