E-Mini Dow: Gapping Down Below the Immediate Support

rhboskres

Publish date: Tue, 21 Dec 2021, 08:40 AM

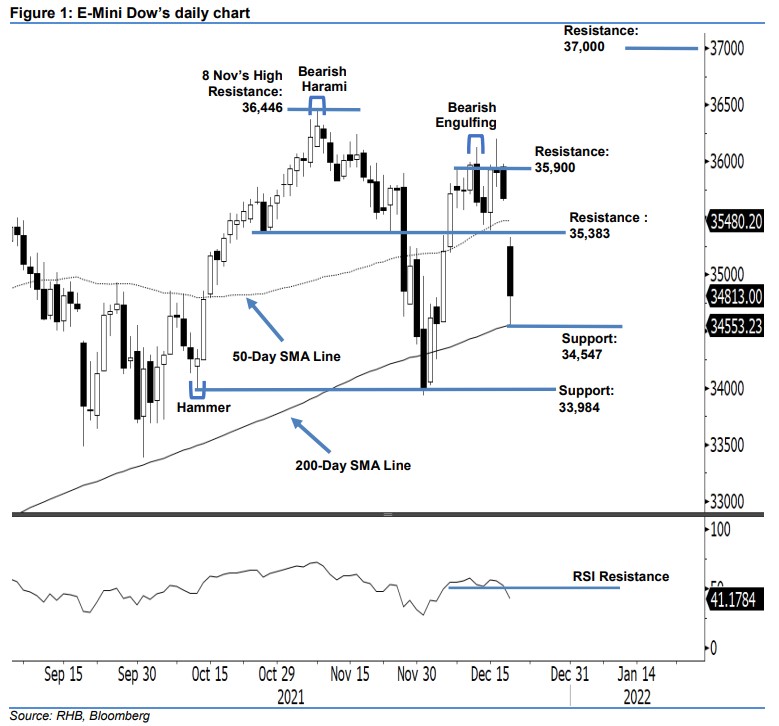

Trailing-stop triggered; initiate short positions. The E-Mini Dow fell sharply below the immediate support yesterday to settle 862 pts lower at 34,813 pts, triggering the trailing-stop level of 35,383 pts. Yesterday, the index gapped down to open at 35,253 pts, then hit the 35,328-pt intraday high before persisting its bearish momentum throughout the session. It touched the day’s low of 34,547 pts during the mid US session before rebounding moderately towards the close at 34,813 pts, partially recouping its intraday losses. The long black body candlestick with a long lower shadow breaching below the immediate support suggests the selling pressure is more obvious, and solidifies the downtrend direction in the medium term. This is also supported by the weakening of the RSI pointing lower towards the 40% level. If the 34,547-pt immediate support is breached, the the E-Mini Dow will be printing below the 200-day SMA line. Since the trailing-stop was triggered, we shift to a negative trading bias.

We closed out our long positions, initiated at 35,212 pts – the closing level of 6 Dec – after the trailing-stop at 35,383 pts was triggered. Conversely, we initiate short positions at the closing level of 20 Dec at 34,813 pts. For risk-management purposes, the initial stop-loss threshold is set at 35,900 pts. The immediate support is revised to 34,547 pts – 20 Dec’s low – followed by 33,984 pts, or the high of 1 Dec. The immediate resistance levels are set at 35,383 pts (27 Nov’s low), and 35,900 pts (26 Nov’s high).

Source: RHB Securities Research - 21 Dec 2021