Hang Seng Index Futures: Attempting to Build An Interim Support

rhboskres

Publish date: Wed, 22 Dec 2021, 04:47 PM

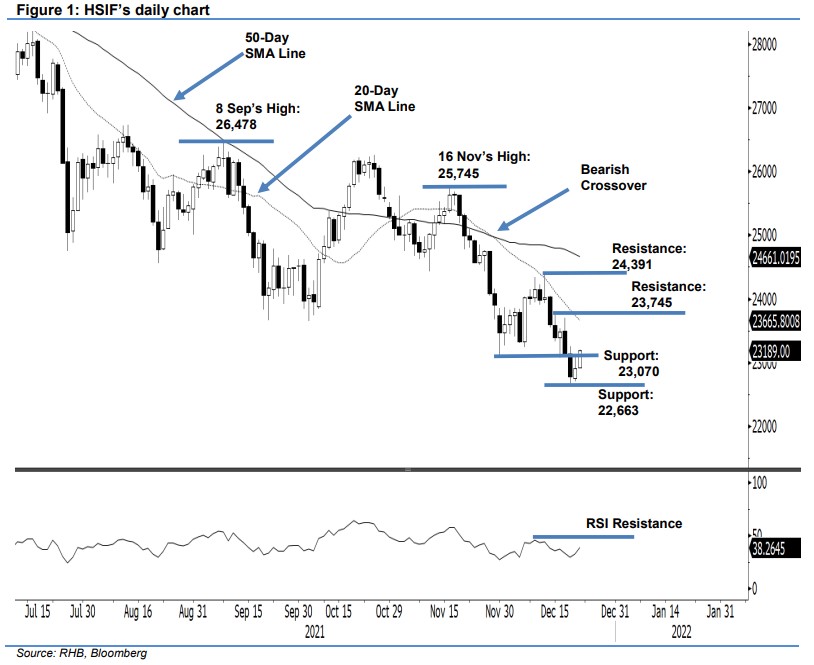

Maintain short positions. The HSIF’s selling momentum receded yesterday, as it bounced off the support to close 128 pts higher at 22,909 pts – despite partial intraday profit-taking activity. It opened at 22,750 pts and gradually moved higher towards the intraday high of 23,087 pts before strong profit-taking dragged the index lower towards the close at 22,909 pts – still above the opening level. In the evening session, buying pressure re-emerged to propel the HSIF higher. It last traded at 23,189 pts. Yesterday’s white body candlestick suggests that the index is attempting to build an interim support, with strong selling pressure to be seen at 23,070 pts. The last traded price breaching above this level indicates that a potential immediate term rebound will continue towards the 23,745-pt resistance. Nevertheless, the medium-term bearish outlook remains intact below the 23,745-pt resistance, coupled with the RSI below 40%. As such, we stick to our negative trading bias until the index triggers the trailing-stop.

Traders should keep the short positions initiated at 24,892 pts, or the closing level of 19 Nov’s evening session. To mitigate trading risks, the trailing-stop is set at 23,745 pts. The immediate support is revised higher to 23,070 pts – 16 Dec’s low – followed by 22,663 pts, or 20 Dec’s low. The nearest resistance is pegged at 23,745 pts – 15 Dec’s high – followed by 24,391 pts, which was 13 Dec’s high.

Source: RHB Securities Research - 22 Dec 2021