E-Mini Dow : Bulls Extend Above the 35,900-Pt Resistance

rhboskres

Publish date: Tue, 28 Dec 2021, 08:39 AM

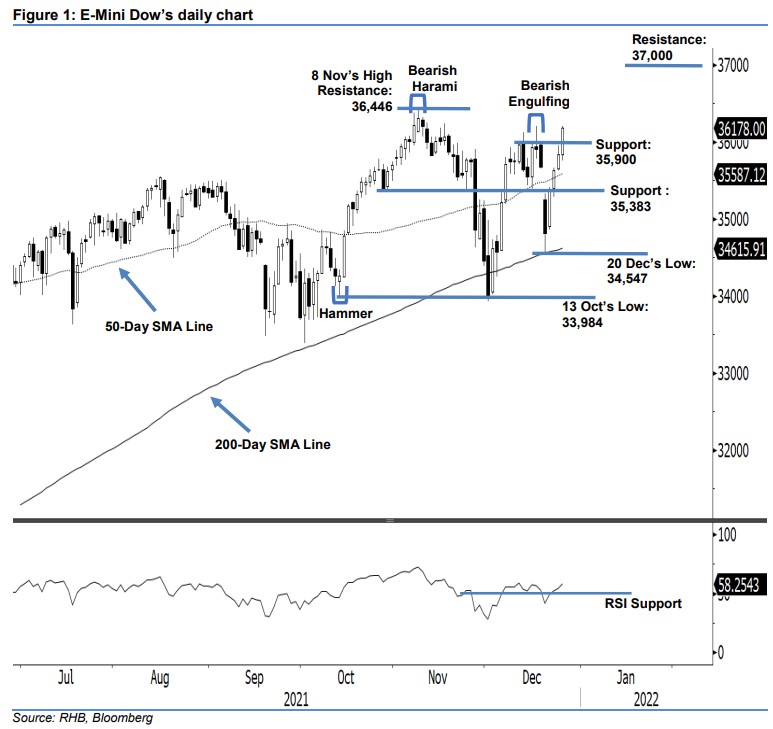

Stop-loss mark triggered; initiate long positions. The E-Mini Dow continued its positive momentum yesterday as it rose 346 pts to close at 36,178 pts – crossing above the 35,900-pt resistance or stop-loss level. It opened at 35,831 pts to touch the 35,759-pt low and then propelled higher towards the day’s peak at 36,206 pts before the close. The long white body candlestick that printed for four consecutive sessions has increased the odds for the bullish bias to continue in the medium term above the 35,900-pt level. This is supported by the improving RSI strength pointing towards the 60% level. However, we expect profit-taking activities to take place in the immediate sessions towards the 50-day average line, or 35,587 pts. Since the stop-loss level has been triggered, we shift to a positive trading bias.

We closed out our short positions initiated at 34,813 pts – or the closing of 20 Dec – after the stop-loss mark at 35,900 pts was triggered. Conversely, we initiate long positions at the closing level of 27 Dec, ie 36,178 pts. For risk-management purposes, the initial stop-loss threshold is set at 35,383 pts.

The immediate support is set at 35,900 pts – 26 Nov’s high – and followed by 35,383 pts or 27 Nov’s low. The immediate resistance levels are pegged at 36,446 pts – 8 Nov’s high – and 37,000 pts.

Source: RHB Securities Research - 28 Dec 2021