WTI Crude : Propelling Higher Towards the 50-Day SMA Line

rhboskres

Publish date: Tue, 28 Dec 2021, 08:39 AM

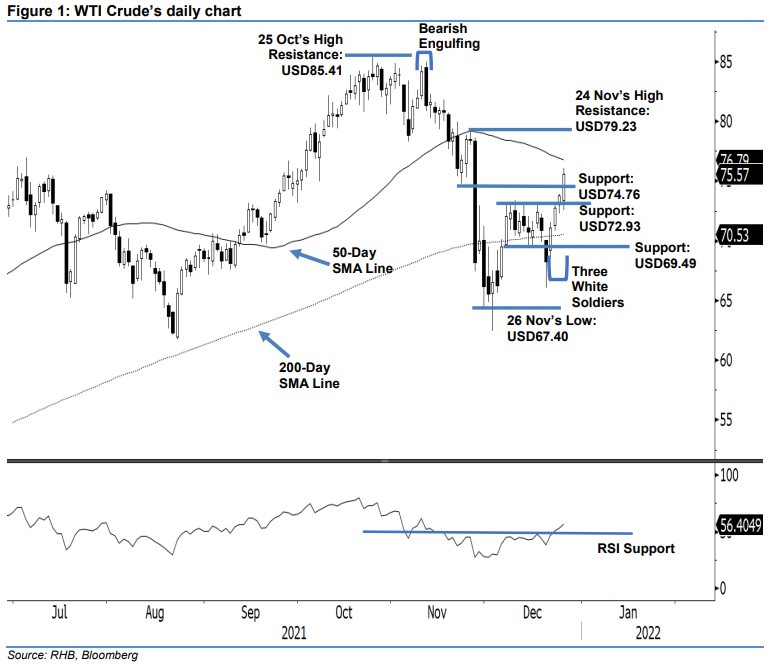

Maintain long positions. The WTI Crude was propelled higher for a fourth consecutive session yesterday as it rose USD1.78 to settle at USD75.57 – crossing above the USD74.76 immediate resistance. Despite the black gold opening lower at USD73.38 and touching the USD72.57 day’s low, the bullish pressure then emerged to uplift the commodity northwards to hit the USD76.09 intraday high before retracing mildly towards the close. The latest long white body candlestick, which printed for a fourth consecutive session (following the recent “Three White Soldiers” bullish pattern) suggests the bullish momentum is gaining more traction towards continuing its northward trend – ie above the 50-day average line in the medium term – by firming up the recent “higher high” bullish structure. As such, we stick to our positive trading bias, which we shifted towards in our previous note.

Traders are advised to keep to the long positions inititated at the closing level of 23 Dec, ie USD73.79. To manage the downside risks, the initial stop-loss threshold is placed at the USD72.93 support.

The immediate support is set at USD74.76 – 22 Nov’s low – and followed by USD72.93, ie 29 Nov’s high. The nearest resistance is fixed at USD79.23 – 24 Nov’s high – and followed by USD85.41, or 25 Oct’s high.

Source: RHB Securities Research - 28 Dec 2021