WTI Crude : Attempting to Move Pass the 50-Day SMA Line

rhboskres

Publish date: Wed, 29 Dec 2021, 06:00 PM

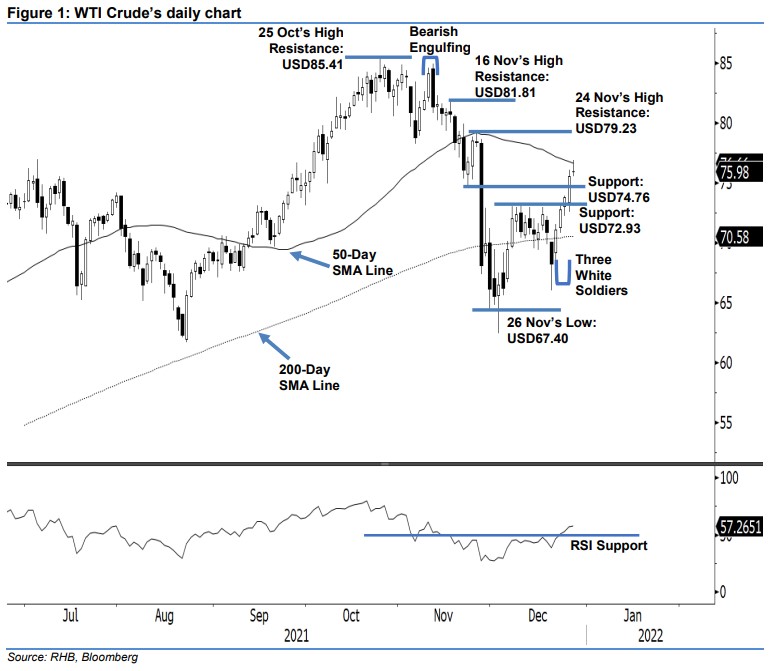

Maintain long positions. The WTI Crude displayed strong intraday profit-taking yesterday – from above its 50-day average line to below it – as it closed near its opening at USD75.98, ie USD0.41 higher than the previous close. The black gold opened higher at USD75.97 and then oscillated between the USD75.53 day’s low and USD76.92 day’s high throughout the sessions. Strong profit-taking took place during the US trading session to drag the commodity lower to close near its opening. The latest “Gravestone doji” bearish reversal candlestick, which touched the 50-day average line, suggests the immediate-term uptrend movement has been capped at the average line level. We expect profit-taking activities to continue in the coming sessions before it propels higher towards the USD79.23 immediate resistance in the medium term. The medium uptrend remains intact, as the RSI is still pointing above the 50% level – supported by the “higher high” bullish structure. Hence, we stick to our positive trading bias.

Traders are advised to keep to the long positions inititated at the closing level of 23 Dec, ie USD73.79. To manage the downside risks, the initial stop-loss threshold is set at the USD72.93 support.

The immediate support is set at USD74.76 – 22 Nov’s low – and followed by USD72.93, ie 29 Nov’s high. The nearest resistance is fixed at USD79.23 – 24 Nov’s high – and followed by USD81.81, or 16 Nov’s high.

Source: RHB Securities Research - 29 Dec 2021