WTI Crude : Inching Higher Towards the 50-Day SMA Line

rhboskres

Publish date: Thu, 30 Dec 2021, 06:51 PM

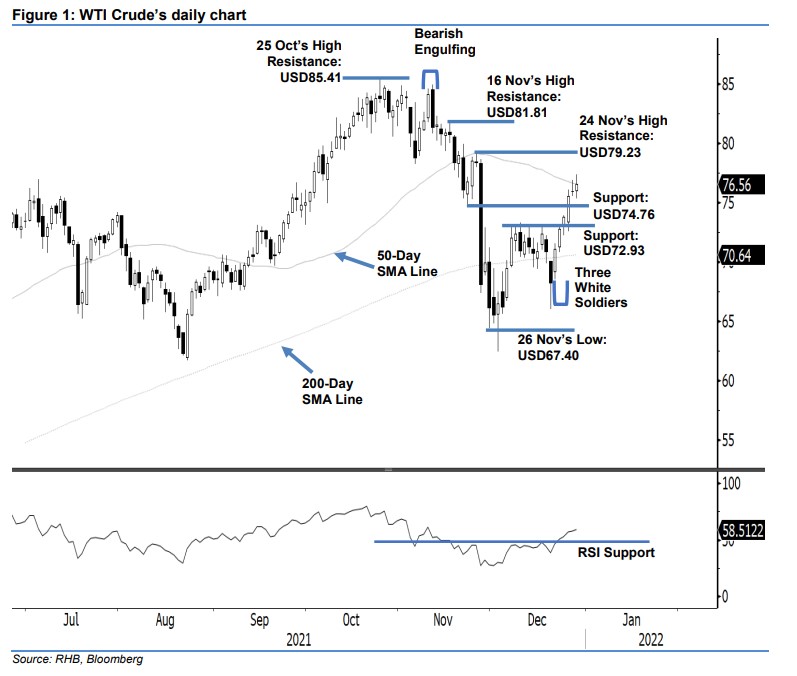

Maintain long positions. The WTI Crude inched upwards towards the 50-day average line yesterday – closing USD0.58 higher at USD76.56 amid intraday profit-taking. The black gold opened at USD76.04 and then oscillated in a choppy fashion between the USD75.36 day’s low and USD77.37 day’s high, rebounding moderately towards the close. The latest white body candlestick with upper and lower shadows indicate that the WTI Crude is being mildly indecisive between profit-taking and rally continuation. Since the RSI is pointing higher towards the 60% level, we expect the commodity to continue its rally above the 50-day average line in the medium term. However, we do not discount the possibility of profit-taking activities taking place in the coming sessions before climbing higher towards the USD79.23 immediate resistance in the medium term. Hence, we stick to our positive trading bias.

Traders are advised to keep to the long positions inititated at the closing level of 23 Dec, ie USD73.79. To manage the downside risks, the initial stop-loss threshold is set at the USD72.93 support.

The immediate support is set at USD74.76 – 22 Nov’s low – and followed by USD72.93, or 29 Nov’s high. The nearest resistance is fixed at USD79.23 – 24 Nov’s high – and followed by USD81.81, ie 16 Nov’s high.

Source: RHB Securities Research - 30 Dec 2021