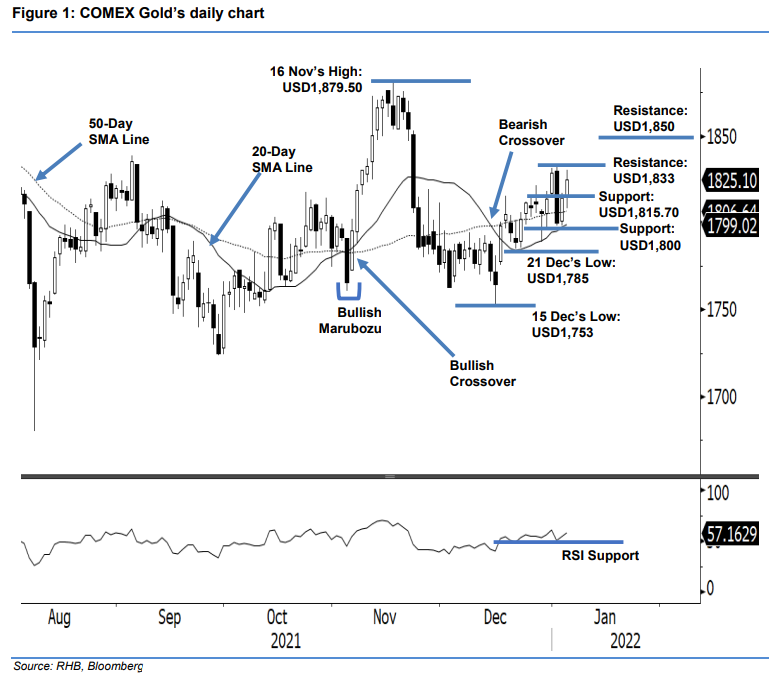

COMEX Gold: Extending the Rebound From the USD1,800 Level

rhboskres

Publish date: Thu, 06 Jan 2022, 04:44 PM

Maintain long positions. After reaching the low near the USD1,800 level on Monday, the COMEX Gold rebounded for the second consecutive session – rising USD10.50 to settle at USD1,825.10. The commodity began yesterday at USD1,815.20, and progressed higher for most of the session, touching the session’s high of USD1,830.70 before pulling back sharply during the late session and testing the session’s low of USD1,808.20. Despite the weak performance at the eleventh hour, it jumped higher to settle at USD1,825.10. For the immediate session, the bulls may attempt to establish a foothold above USD1,815.70. If the commodity manages to sustain above the threshold, it may test the recent high of USD1,833. Otherwise, it may see some profit taking activities and retrace towards the USD1,800 pyschological support. As long as the commodity stays above the 20-day SMA line, we believe the upward movement is still in play – as such, we stick to our positive trading bias.

We recommend traders hold on to their long positions at USD1,811.70 – the closing level of 23 Dec 2021. To protect the downside risks, the stop-loss is set at the USD1,800 psychological level.

The immediate support is revised to USD1,815.70 – 17 Dec 2021’s high – followed by the USD1,800 round figure. Meanwhile, the nearest resistance is set at USD1,833 – 3 Jan’s high – followed by USD1,850.

Source: RHB Securities Research - 6 Jan 2022