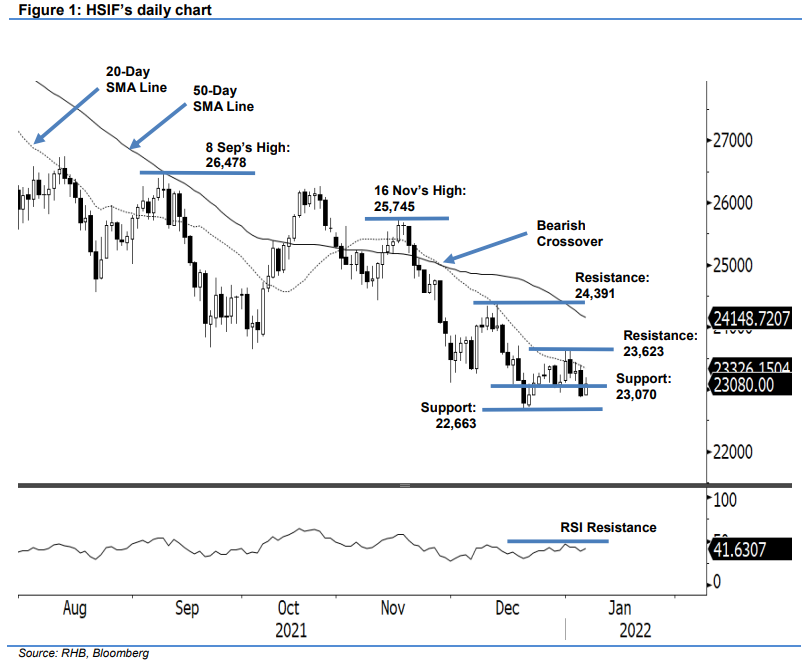

Hang Seng Index Futures: Trending Lower Below the 20-Day SMA Line

rhboskres

Publish date: Thu, 06 Jan 2022, 04:45 PM

Maintain short positions. The HSIF experienced another bearish session yesterday, falling 393 pts to settle weaker at 22,903 pts. Initially, it started off at 23,247 pts and rose to test the session’s high of 23,329 pts. However, the positive momentum failed to inspire the bulls, resulting in the index heading southwards for the rest of the day session, with the low of 22,864 pts before the close. During the evening session, the bulls staged a rebound to recoup 177 pts to last trade at 23,080 pts. At this stage, the immediate support of the 23,070-pt level is considered intact. As mentioned previously, since the RSI is hovering below 50%, the momentum will remain weak, with downside risk persisting. If the immediate support gives way, the index may correct lower to retest the recent low at the 22,663-pt level. As the index is trading below the 20-day SMA line, we hold on to our negative trading bias.

Traders are advised to retain the short positions initiated at 24,892 pts, or the closing level of 19 Nov 2021’s evening session. To protect the trading risks, the trailing stop is set at 23,745 pts.

The nearest support remains at 23,070 pts – 16 Dec 2021’s low – followed by 22,663 pts, or the low of 20 Dec 2021. Towards the upside, the immediate resistance is revised to 23,623 pts – 03 Jan’s high – and the higher hurdle of 24,391 pts (13 Dec 2021’s high).

Source: RHB Securities Research - 6 Jan 2022