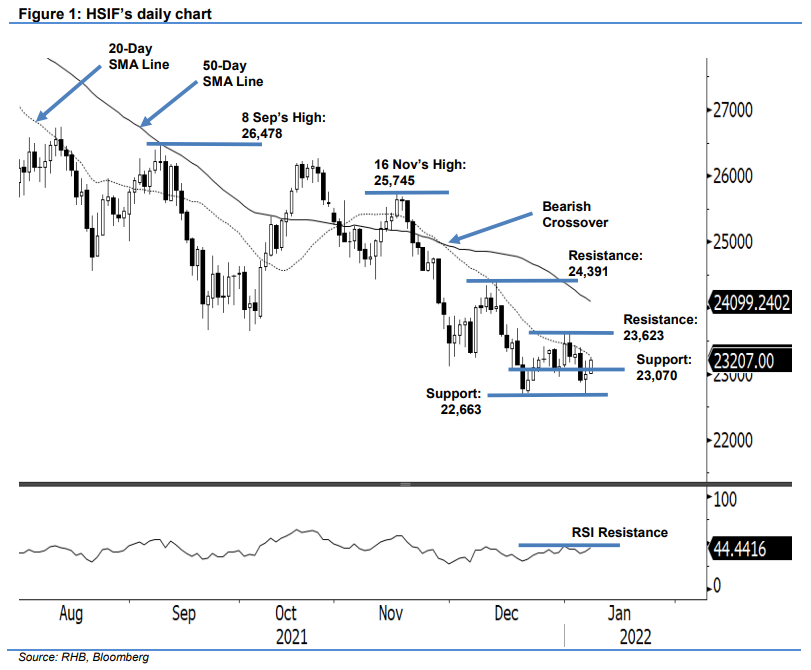

Hang Seng Index Futures: Hovering Near the Immediate Support Level

rhboskres

Publish date: Fri, 07 Jan 2022, 05:16 PM

Maintain short positions. The HSIF rebounded from the immediate support, and is eyeing the overhead resistance of the 20-day SMA line. It rose 89 pts yesterday, to settle the day session at 22,992 pts. The intraday low was recorded at 22,710 pts, followed by the intraday high at 23,090 pts. Bullish momentum continued in the evening session – adding 215 pts and last trading at 23,207 pts. Despite the 20-day SMA line trending lower and exerting selling pressure on the index, the bulls defended the immediate support at 23,070 pts. If the threshold sustains, the bulls may attempt to cross above the 20-day SMA line to test the recent high or resistance at 23,623 pts. Meanwhile, if selling pressure accelerates again, the index may correct towards 2021’s low of 22,663 pts. As the index is still charting “lower highs with lower lows”, we retain our negative trading bias until the trailing-stop is triggered.

Traders should hold on to the short positions initiated at 24,892 pts, or the closing level of 19 Nov 2021’s evening session. For risk management, the trailing stop is revised to 23,700 pts from 23,745 pts.

The nearest support stays at 23,070 pts (16 Dec 2021’s low), followed by 22,663 pts, or the low of 20 Dec 2021. Conversely, the immediate resistance is pegged at 23,623 pts (3 Jan’s high), followed by 24,391 pts (13 Dec 2021’s high).

Source: RHB Securities Research - 7 Jan 2022