COMEX Gold: Re-Testing the Immediate Support Near USD1,830

rhboskres

Publish date: Thu, 27 Jan 2022, 04:43 PM

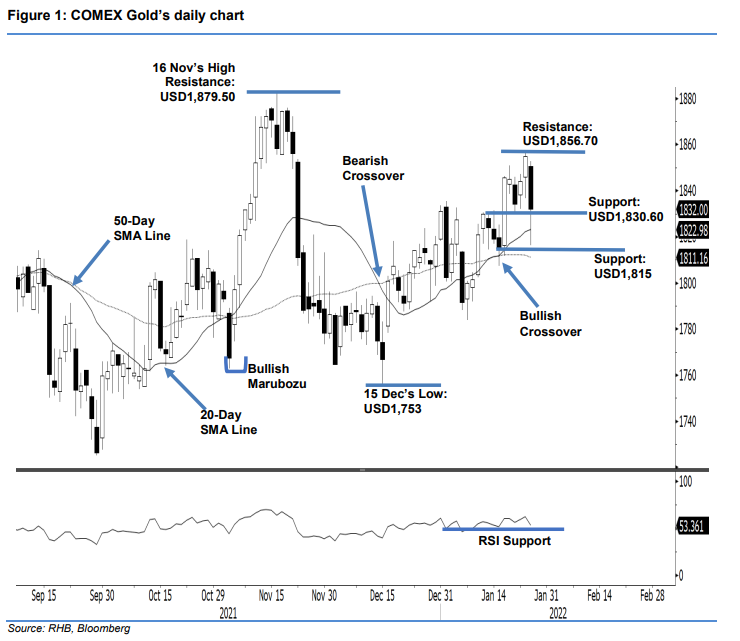

Maintain long positions. The COMEX Gold’s April futures contract experienced strong profit-taking yesterday, slipping USD23.00 to settle at USD1,832 – just above the USD1,830.60 resistance. The commodity initially bagan at USD1,850.70 and progressed lower. The negative momentum accelerated during the US session, dragging the COMEX Gold to touch the USD1,816.40 day low before it rebounded to close at USD1,832. The latest session suggests that USD1,830.60 will act as a strong support. Breaching this threshold may see the commodity retrace towards the 50-day SMA line. If it stays above this line, the Bullish Crossover will remain valid and, hence, the precious metal may resume its upward movement soon. Premised on this, we stick to our positive trading bias.

We recommend traders hold on to long positions initiated at USD1,818.50, ie the closing of 11 Jan. To protect against downside risks, the initial stop-loss threshold is placed at USD1,775.

The immediate support is marked at USD1,830.60 or 21 Jan’s low. Lower support is adjusted to the USD1,815 whole number. Conversely, the immediate resistance remains at USD1,856.70 – 26 Jan’s high – and is followed by the previous high of USD1,879.50, ie the high of 16 Nov 2021.

Source: RHB Securities Research - 27 Jan 2022