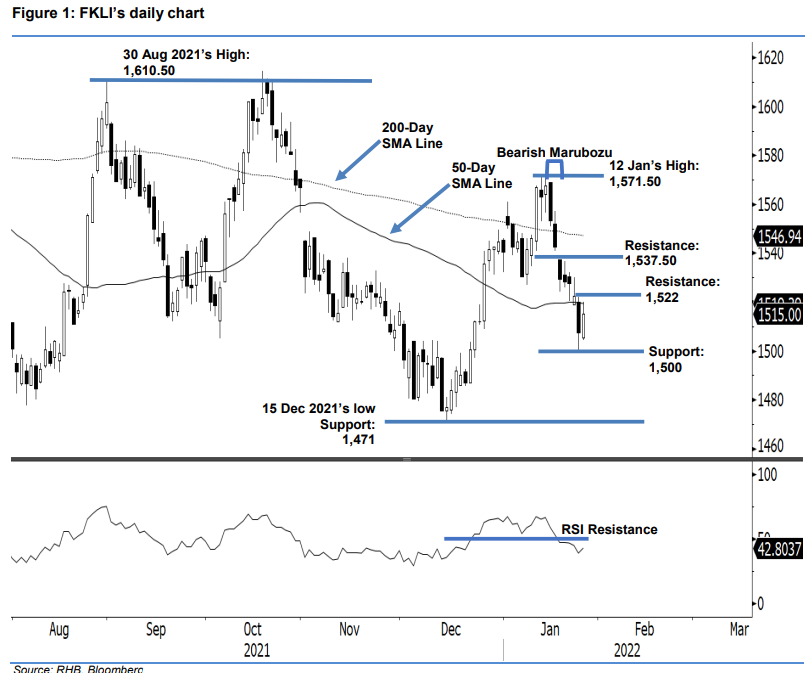

FKLI: Attempting To Rebound Above The 50-Day SMA Line

rhboskres

Publish date: Thu, 27 Jan 2022, 04:53 PM

Maintain short positions. The FKLI attempted to reverse its downtrend movement yesterday, climbing 7.5 pts to settle at 1,515 pts – bouncing off the support to touch the 50-day SMA line. The index initially opened at 1,505.5 pts to merely touch the 1,504.5-pt day low and then jumped strongly towards touching the day high of 1,520 pts before retreating mildly to close at 1,515 pts. The latest bullish candlestick, which closed below the previous day’s high, shows the mild positive rebound may be shortlived, as it has yet to cross above the 1,522-pt immediate resistance and also the 50-day average line. We expect the FKLI to oscillate between the 1,522-pt resistance and 1,500-pt support in the coming sessions, with a higher possibility of breaching below the 1,500-pt support in the medium term – given that the RSI is still hovering below the 50% level. As the negative momentum still in play, we are keeping our negative trading bias.

We recommend traders keep to the short positions initiated at 1,542.50 pts, ie the close of 17 Jan. To minimise the trading risks, the stop-loss threshold is set at 1,550 pts.

The immediate support is pegged at the 1,500-pt psychological mark, followed by 1,471 pts or the low of 15 Dec 2021. Meanwhile, the first resistance is still at 1,522 pts – 25 Jan’s high – and followed by 1,537.50 pts, ie the high of 19 Jan.

Source: RHB Securities Research - 27 Jan 2022