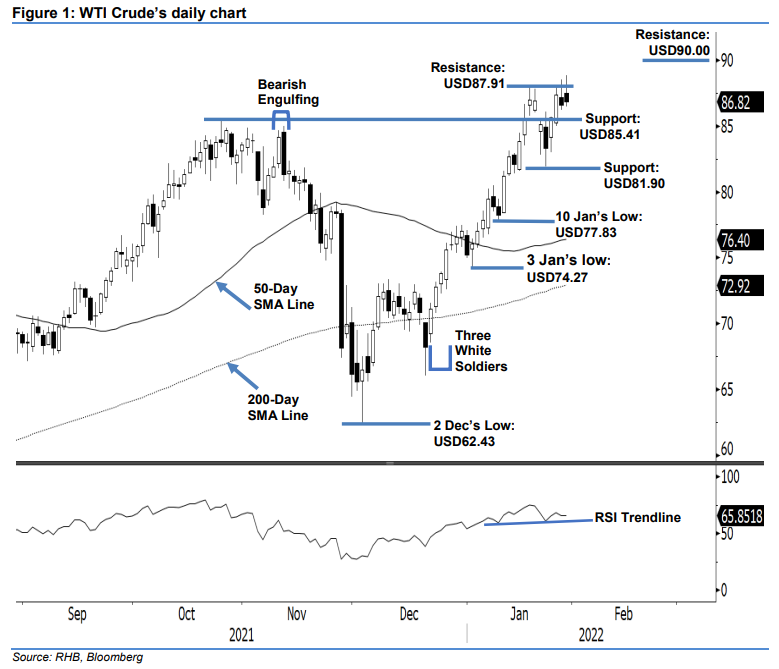

WTI Crude: Still Struggling to Surpass the USD87.91 Resistance

rhboskres

Publish date: Mon, 31 Jan 2022, 08:47 AM

Maintain long positions. The WTI Crude re-attempted to climb higher last Friday but failed to sustain amid strong intraday profit-taking. It closed slightly higher than Thursday’s close by USD0.21 at USD86.82 – below Friday’s opening level. Despite opening higher at USD87.50, the WTI Crude oscillated in a sideways direction before strong buying interest emerged during the early US trading session to hit the USD88.84 intraday high. However, strong selling pressure appeared from the top to drag the black gold towards the day’s low at USD86.44 prior to the close. The latest black candlestick with long upper shadow – which printed a “higher low” against Thursday’s price – suggests that, despite strong intraday selling pressure at USD87.91, the buying pressure is set to stay relevant above the USD85.41 immediate support. We still expect strong buying interest above this support in the coming sessions and remain bullish in the medium term. Hence, we stick to our positive trading bias.

We recommend traders keep to the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. For risk management, the trailing-stop threshold is set at USD81.90.

The immediate support is pegged at USD85.41 – 25 Oct 2021’s high – and followed by USD81.90, ie the low of 24 Jan. Conversely, the immediate resistance is at USD87.91 – 19 Jan’s high – and followed by USD90.00.

Source: RHB Securities Research - 31 Jan 2022