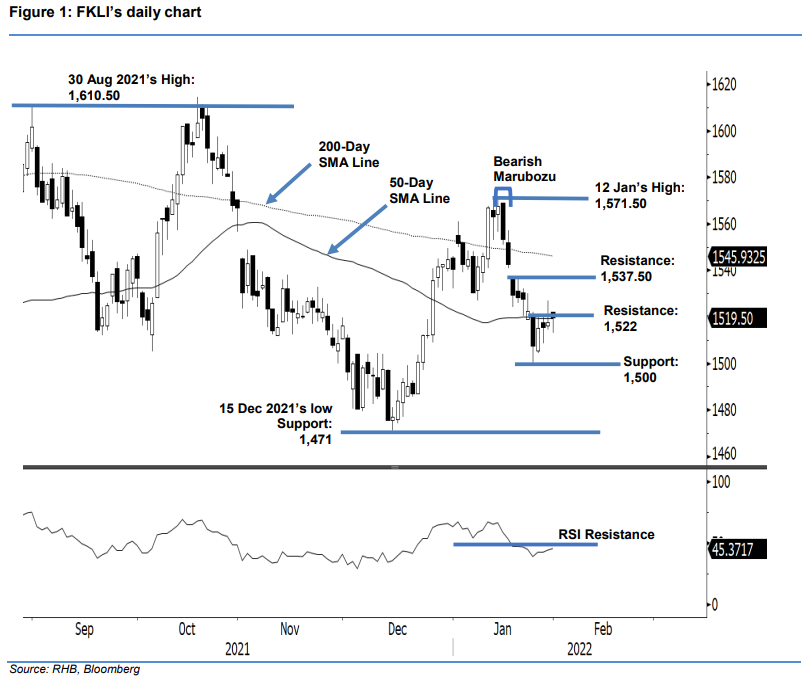

FKLI: Still Blocked By The 50-Day SMA Line Resistance

rhboskres

Publish date: Thu, 03 Feb 2022, 06:10 PM

Maintain short positions. Despite facing selling pressure, the FKLI’s January futures contract managed to stage a rebound and added 2 pts to settle at 1,519.50 pts on Monday. The benchmark index opened at its day high of 1,522 pts before falling to the 1,513-pt day low and bouncing before closing at 1,519.50 pts. In comparison, the FKLI’s February futures contract closed Monday’s session near its day low at 1,510 pts. Hence, we expect the benchmark index or February’s futures contract will open weaker during the Thursday session. Since the RSI has been rounding up lately – suggesting a mild bullish momentum – we think the bulls may attempt to reclaim the 50-day SMA line. Based on recent price actions, this line still acts as strong overhead resistance. If the FKLI manages to cross above the 1,522-pt resistance, it may climb higher to test the 1,537.50-pt resistance. Otherwise, the index may consolidate below the 50- day SMA line. At this stage, we hold on to our negative trading bias until the trailing-stop mark is triggered.

We advise traders to retain the short positions initiated at 1,542.50 pts or the close of 17 Jan. To mitigate the trading risks, the trailing-stop threshold is set at 1,527 pts.

The immediate support remains at the 1,500-pt psychological point, followed by 1,471 pts or the low of 15 Dec 2021. Meanwhile, the first resistance is pegged at 1,522 pts – 25 Jan’s high – and followed by 1,537.50 pts, ie the high of 19 Jan.

Source: RHB Securities Research - 3 Feb 2022