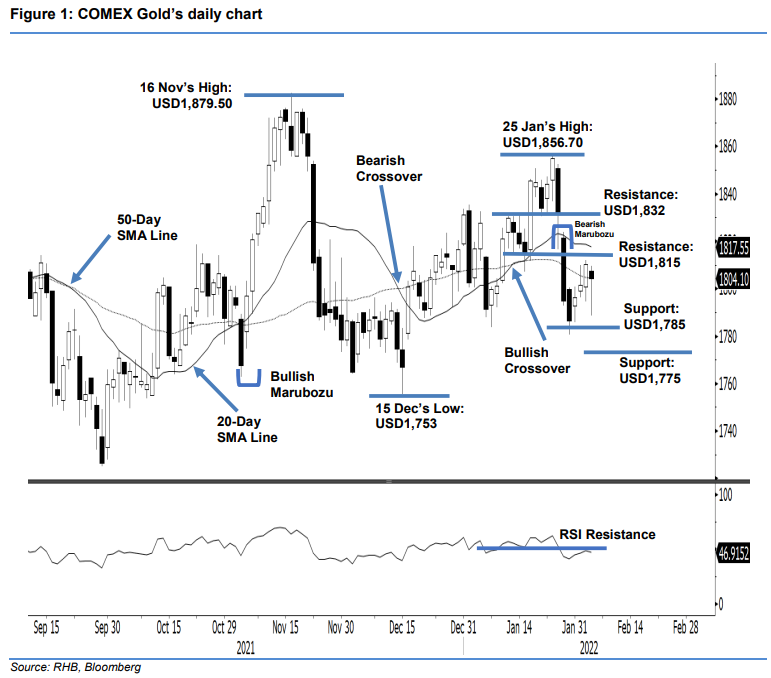

COMEX Gold: Staying Above the 50-Day SMA Line Support Level

rhboskres

Publish date: Fri, 04 Feb 2022, 09:58 AM

Maintain long positions. The COMEX Gold experienced strong profit-taking yesterday. It pared its intraday losses to decline USD6.20 and settle at USD1,804.10 – still above the 50-day SMA line. The commodity started at USD1,807.40 on Thursday. At one point, it fell to the day’s low of USD1,788.50 on strong selling activity. It then staged a rebound, during the US trading session, to close at USD1,804.10. Yesterday’s low of USD1,788.50 was higher than 28 Jan’s low of USD1,780.60, and hence, a “higher low” has been recorded. The price action indicates that the bulls are still in control of the trend, despite facing profit-taking recently. As long as the precious metal continues to trade above the 50-day SMA line, we think it will resume upside movement after consolidation. As such, we keep our positive trading bias.

We recommend traders hold on to the long positions initiated at USD1,818.50, or the closing level of 11 Jan. To minimise trading risks, the initial stop-loss threshold is set at USD1,775.

The immediate support stays at USD1,785, followed by the USD1,775 whole number. Conversely, the immediate resistance is set at USD1,815, and the higher resistance at USD1,832, or the close of 26 Jan.

Source: RHB Securities Research - 4 Feb 2022