Hang Seng Index Futures : Reclaiming the 20-Day SMA Line

rhboskres

Publish date: Mon, 07 Feb 2022, 09:20 AM

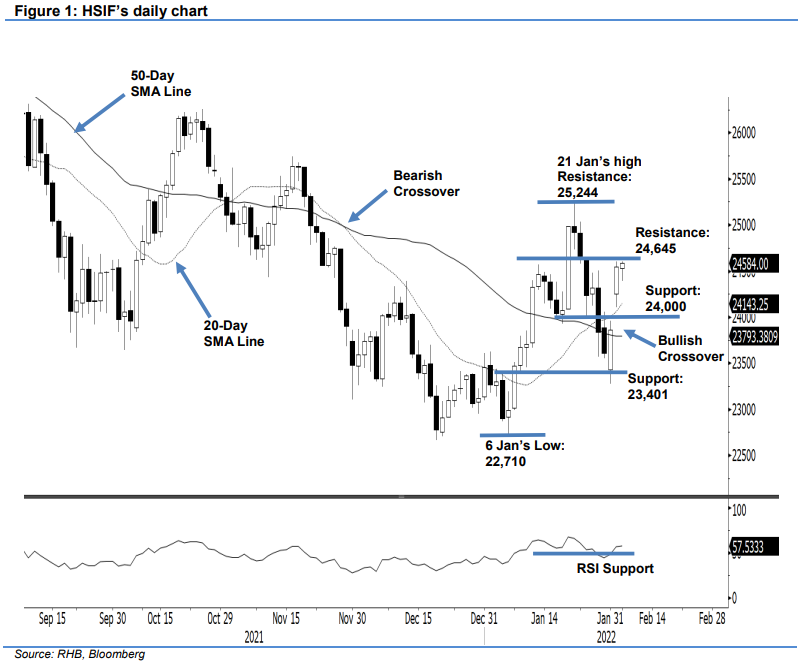

Maintain short positions. The HSIF surged – as it resumed trading after the holiday – jumping 681 pts to settle the day session at 24,543 pts. It gapped up to begin Friday’s session at 24,250 pts. After touching the day’s low of 24,105 pts, it climbed to touch the session’s 24,605-pt high before closing with a long white candlestick. In the evening, bullish momentum continued to lift the index by 41 pts, and last traded at 24,584 pts. Amidst strong momentum, the index managed to cross above the 20-day SMA line and reclaim the 24,000-pt psychological level. Despite rising on renewed momentum, the index may face stiff resistance at 24,645 pts. If the momentum follows through and breaks past the immediate threshold, the index may attempt to retest the 25,244-pt level, which is the YTD high. For now, we retain our negative trading bias until the HSIF breaches above the stop-loss level.

Traders should keep the short positions initiated at 23,840 pts or the closing level of 27 Jan day’s session. To manage trading risks, the initial stop-loss is set at 24,645 pts.

The immediate support is shifted higher to the 24,000-pt round figure, followed by 23,401 pts, or the low of 10 Jan. The immediate resistance is eyed at 24,645 pts –25 Jan’s high – followed by 25,244 pts, which is the YTD high.

Source: RHB Securities Research - 7 Feb 2022