WTI Crude: Setting Foot Above the USD90.00 Mark

rhboskres

Publish date: Tue, 08 Feb 2022, 08:40 AM

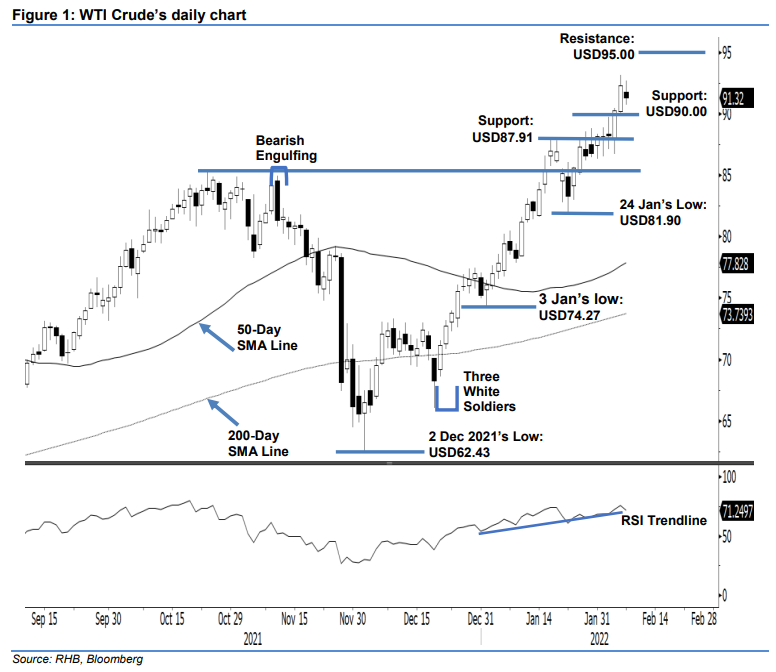

Maintain long positions. The WTI Crude bulls took a breather yesterday, as the commodity pulled back USD0.99 to settle at USD91.32. It gapped down to open at USD91.82, and closed near the opening price at USD91.32 after trading in the range of USD92.73 and USD90.73. Despite the commodity’s recent bullish momentum failing to follow through yesterday, it managed to stay above the USD90.00 support level. The session’s low of USD90.73 is higher than 4 Feb’s low of USD90.07, and hence, the Black Gold is deemed to be charting a “higher low” bullish pattern. If selling pressure continues, we think the USD90.00 level will provide strong support. With the bullish structure still intact, we make no change to our bullish trading bias.

Traders should hold on to the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage downside risks, the trailing-stop is fixed at USD85.41, or the high of 25 Oct 2021.

The immediate support is set at USD90.00, followed by USD87.91, which was the high of 19 Jan. On the upside, the immediate resistance is eyed at USD95.00, followed by the USD100.00 psychological point.

Source: RHB Securities Research - 8 Feb 2022