E-Mini Dow: Struggling Near the 200-Day SMA Line Support

rhboskres

Publish date: Tue, 08 Feb 2022, 09:20 AM

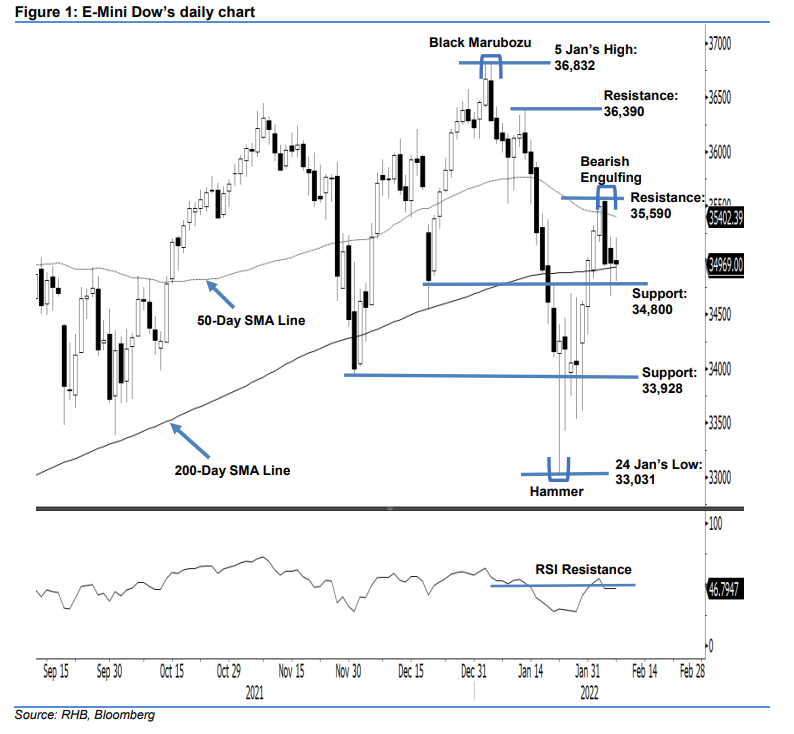

Maintain long positions. The E-Mini Dow struggled to fend off selling pressure yesterday, dipping 9 pts to settle at 34,969 pts – maintaining its position above the 200-day average line. It opened neutral at 35,002 pts. After hovering within the tight range of 35,205 pts and 34,806 pts, it closed at 34,969 pts. Looking at the RSI indicator, the momentum is still pointing below the 50% threshold, suggesting that the index will undergo a consolidation phase. If it fails to retain the 200-day SMA line, and breaches below this level, selling pressure may drag it towards the next support level at 33,928 pts. Meanwhile, based on the 4 Feb and 7 Feb candlesticks, the index has charted a long lower shadow, showing that the bulls were building an interim base near the 200-day SMA line. We hold on to our positive trading bias until the stop-loss is triggered.

We advise traders to keep the long positions initiated at 34,997 pts or the closing level of 31 Jan. For risk-management purposes, the stop-loss is placed at 34,800 pts.

The immediate support stays at 34,800 pts, followed by 33,928 pts or the low of 1 Dec 2020. The immediate resistance is pegged at 35,590 pts – 2 Feb’s high – followed by 36,390 pts, which was 13 Jan’s high.

Source: RHB Securities Research - 8 Feb 2022