Hang Seng Index Futures: Bouncing Off the 20-Day SMA Line

rhboskres

Publish date: Wed, 09 Feb 2022, 08:38 AM

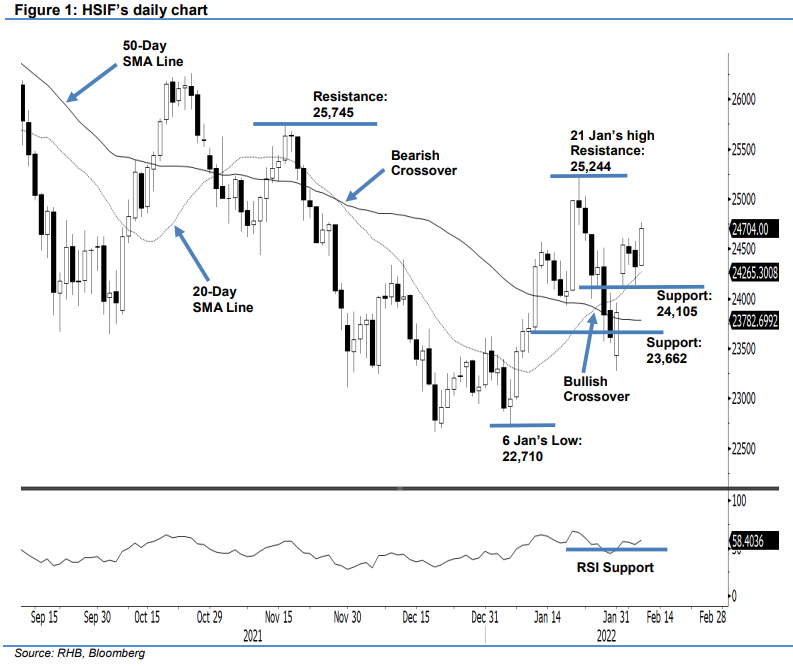

Stop-loss triggered; Initiate long positions. The HSIF saw a session of two halves yesterday. It first retraced 132 pts to settle the day session at 24,324 pts. Then, in the evening – encouraged by its US peers – bullish sentiment lifted the index by 380 pts. It last traded at 24,704 pts. The positive price action saw the index breach above the previous resistance level of 24,645 pts, forming a fresh “higher high” bullish pattern. The index also strengthened its position above the 20-day SMA line. In the event that the bears decide to take profit, we expect the 50-day SMA line to provide strong downside support. As the index has breached the stop-loss – indicating that bullish momentum is picking up pace – we shift over to a positive trading bias.

We closed out the short positions initiated at 23,840 pts or the closing level of 27 Jan’s day session, after the initial stop-loss at 24,645 pts was triggered. Conversely, we initiate long positions at the close of 9 Feb’s evening session, or 24,704 pts. To mitigate trading risks, the initial stop-loss is set at 23,662 pts.

The immediate support is marked at 24,105 pts (4 Feb’s low), followed by 23,662 pts, or the low of 12 Jan. On the other hand, the immediate resistance is eyed at 25,244 pts (21 Jan’s high), followed by 25,745 pts, or 16 Nov 2021’s high.

Source: RHB Securities Research - 9 Feb 2022