COMEX Gold: Getting Firmer Above the 20-Day SMA Line

rhboskres

Publish date: Thu, 10 Feb 2022, 05:31 PM

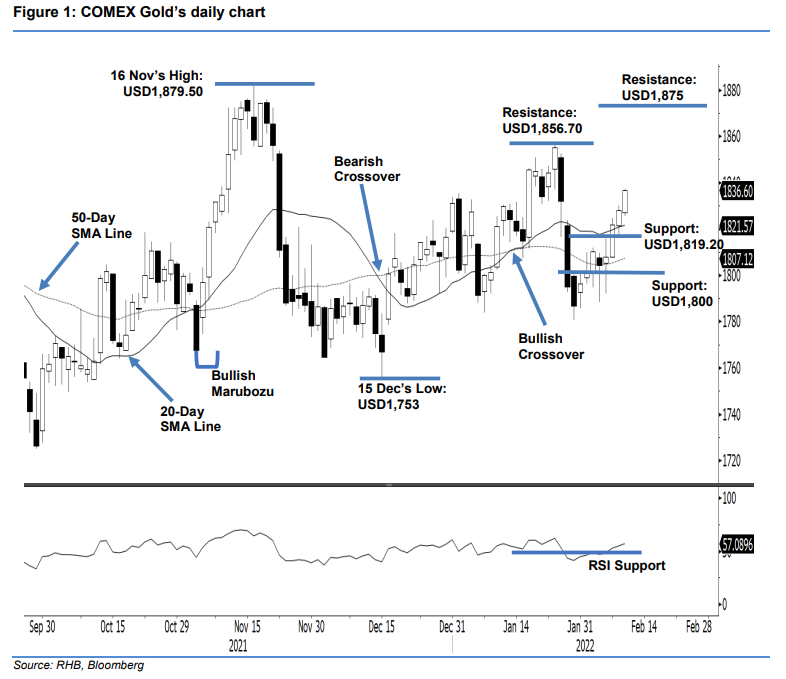

Maintain long positions. The COMEX Gold extended the upside movement yesterday, rising USD8.70 to settle at USD1,836.60 – breaching the previous USD1,832 resistance. The commodity began at USD1,827. Not long after the session started off, it formed an intraday low at USD1,825.50. It then moved northwards and touched the USD1,837.10 session high before the close – printing a fresh “higher high” bullish pattern. The latest price action reaffirmed that the bulls are in control of the recent trend. As mentioned in our previous note, both the 20- and 50- day SMA lines are trending higher – providing a strong cushion should the COMEX Gold face profit-taking again. Amidst the strong momentum, the yellow metal may set its sights on the USD1,856.70 resistance, ie the recent high. With the bullish structure remaining intact, we stick to our positive trading bias.

We advise traders to keep to the long positions initiated at USD1,818.50 or the closing level of 11 Jan. To mitigate the trading risks, the stop-loss threshold is set at USD1,785.

The immediate support is revised to USD1,819.20 – 8 Feb’s low – and followed by the USD1,800 round figure. Conversely, the immediate resistance is pegged at USD1,856.70 – 25 Jan’s high – and followed by the USD1,875 whole number.

Source: RHB Securities Research - 10 Feb 2022